The rise of multi-alternatives

|

Written By: John Wilkinson |

John Wilkinson of LGT Capital Partners takes us through a number of alternative investments and outlines the reasons for the increasing popularity of the asset class

The seemingly stable investment landscape of the past was fundamentally and drastically altered after the pivotal Lehman crash event in September 2008. Since then, despite the numerous and ongoing central bank interventions, quantitative easing programmes and bailouts, the quest for self-sustaining global economic growth is turning out to be a Keynesian pipedream. With the implosion of the Chinese stock market and now diminishing effectiveness of any future easing, global markets are experiencing serious signs of distress and volatility which has been reappearing in violent bursts.

In this “new normal” market environment, investing in alternatives has been on the rise from institutional investors, including pension funds who seek to reduce their portfolio exposure to traditional market volatility whilst enhancing returns from less correlated return drivers.

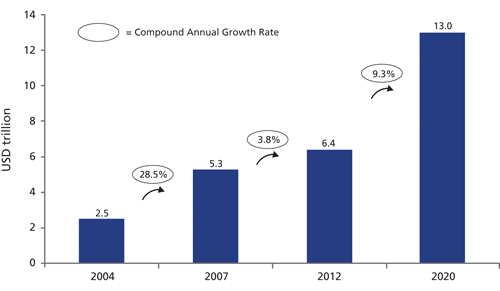

A recent study from McKinsey shows that alternative investments have grown twice as fast as traditional investments since 2005, and a PwC analysis forecasts that the growth of alternative investments will accelerate to become a USD 13 trillion industry by 2020 (Figure 1).

Figure 1: Alternative investments growth

Source: PwC analysis. Past data based on Towers Watson, Preqin, The City UK and Hedge Fund Research

So what is meant by alternative investments and why are they becoming more popular?

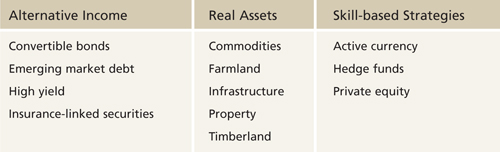

In the broadest sense, alternative investments encompass all of the possible investments not included in the traditional equity and bond allocations that have dominated the typical pension fund portfolio for so many years. Figure 2 gives a core range of possible alternative investments accessible today to institutional investors.

Figure 2: Core range of alternative investments accessible to institutional investors

Source: LGT Capital Partners

The key driver for the increased interest in alternatives has been the diversification they add to a portfolio and the positive impact this has on the consistency of funding levels. The equity allocation within most pension funds accounts for a disproportionate amount of the total risk. An allocation to alternative investments, at the expense of equities, can be an effective way to diversify the risk without compromising returns. However, you must be aware that alternatives can also perform very differently through cycles. For example, commodities have been battered in the past few years whilst property recovered strongly. Looking ahead, private equity and hedge fund strategies with lower beta seem more likely to outperform public equities.

To get a better idea of how alternatives can offer diversification and different sources of returns, let’s briefly go through a couple of examples:

Insurance linked securities

ILS investments are becoming more mainstream. They are structured in a similar way to fixed income bonds except that the risk/return drivers are almost completely unrelated to the financial markets.

ILS investors earn a premium on their catastrophe bonds (or collateralised reinsurance contracts) as well as the money market return from the collateral assets. However, insurance policyholders will claim on the bond (or contract) if certain pre-specified loss levels are “triggered” from a natural catastrophe, for example, a large US earthquake or European windstorms/floods. If this happens, the ILS investment will lose value.

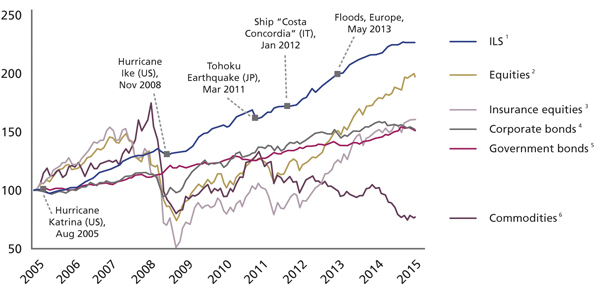

Figure 3 shows how the ILS cat bond index achieved consistent returns with low correlation versus a range of other asset classes. Most investment portfolios would have benefited from the inclusion of ILS, especially during the financial crisis in 2008.

Figure 3: Performance (rebased)

Source: LGT ILS Partners, Barclays Capital, Citigroup Index, Bloomberg; performance is in USD gross of fees; data as of 31 July 2015. Past performance is not a guarantee of future results, nor an indication of current or future performance. Management fees and other fees will influence the performance negatively.

1. Swiss Re Cat Bond Total Return Index

2. MSCI World TR

3. BarCap GlobalAgg Corporate TR

4. Citigroup WGBI TR

5. MSCI World Insurance Equities

6. DJ UBS Commodities Index TR

Risk premiums have reduced over the past couple of years due to the lack of natural catastrophe activity, but collateralised reinsurance contracts are still viewed as attractive compared with the risk premia to be found today in many other financial assets. Of course, if a very rare major natural catastrophe was actually to occur, then those ILS investments covering this type of event may potentially suffer losses. So it is important to ensure that any ILS portfolio is very well diversified across regions and disaster types, and that you fully understand the level of risk you are being exposed to.

Trend-following strategies/CTAs

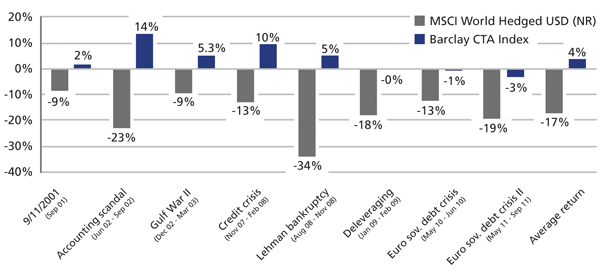

As a second example, trend-following strategies (otherwise known as CTAs), which went through a dry spell during 2010-13, silenced critics by making a fierce comeback during the course of last year to reach a new cumulative performance high. In general, the strategy’s long-term track record (net of fees) remains impressively solid and has historically proven successful in protecting against periods of market turmoil, as shown in Figure 4 below.

Figure 4: Downside protection by Commodity Trading Advisors (CTAs)

Source: LGT Capital Partners

The mathematically-minded will understand why avoiding big losses in the first place is paramount to being able to achieve an attractive compound rate of return, which is why trend-following strategies have an important role to play in a multi-alternatives portfolio.

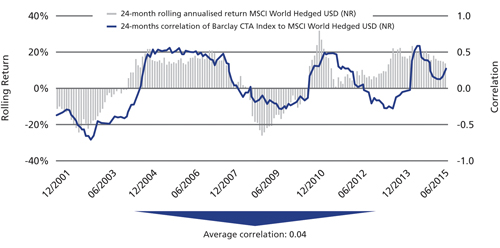

Another powerful benefit of these strategies is that they can profit during long-term bull as well as bear markets, since trends typically always materialise. Figure 5 shows the dynamic correlation that trend-following strategies have vs. equities as well as the performance of equities. The idea is that when equities are performing, the correlation with CTAs turns positive, and when equities are falling the correlation turns negative. Overall, the historical correlation since 2001 has been near zero, thereby serving as an efficient source of portfolio diversification.

Figure 5: 24-month rolling annualised return/correlation of CTAs versus MSCI

Source: LGT Capital Partners

It is often commented that these strategies can be like a black box in nature and complicated to understand, but it is possible to have 100% transparency if accessed through the correct channels such as a managed account platform which is monitored by an experienced team.

How can a pension fund allocate to alternative investments?

As we have seen from the two examples, alternative investments are generally more complex to understand and require specialist knowledge and experience to successfully navigate.

Whilst the very largest pension funds have the resources to cope with the greater complexity, for smaller sized schemes or ones with limited resources, options have been few. Multi-alternative funds specifically seek to address this gap and can provide small and medium-sized schemes with an effective and efficient way to diversify their sources of return. A pension fund that has exposure to a broader range of risk/return drivers will tend to produce more consistent returns, which is beneficial for funding ratios, and for possible additional funding requirements from the corporate sponsor.

Accessing alternative investments is also not straightforward. Without the appropriate governance structures in place, the burden of appointing numerous specialist managers and ensuring the appropriate level of monitoring could be extremely time consuming. Even where managers are easily identifiable, spreading the alternative allocation among say a dozen managers often leaves the pension fund unable to meet the minimum subscription requirements of the best managers. A multi-alternative fund seeks to solve these issues and make the entire spectrum of alternatives easily accessible.

Internal vs external fund allocations

There has been an increasing number of investment managers that offer multi-alternative solutions. Typically, they will actively manage the asset allocation across the range of alternatives and select the best managers for each asset class. There are three different possible options. The first is the sole use of internal funds. Here the manager of the multi-alternative portfolio would only allocate to internally managed funds. Even with the advantage of a lower cost, few, if any, asset managers have the internal expertise that span a sufficient range of alternatives to make this an attractive proposition. The second is a combination of internal and external funds. Most investment managers allocate to their own in-house teams, only using external managers where they do not have any expertise. There is however a risk that asset allocation decisions and especially the selection of internal vs external managers can fall victim to company politics or conflicts of interest. Thirdly, the sole use of external funds. A small number of investment managers specifically use only third party managers. This may come with a slightly higher cost but it does avoid any possible conflicts of interest.

Tailor-made solutions

For larger size investments, tailor-made multi-alternative solutions are also feasible. In this scenario, the investment manager would determine the asset allocation with specific risk/return objectives in mind, taking into account the strategic benchmark that is in place for the traditional assets in the rest of the portfolio. This also implies that certain alternative investments could be excluded if desired. For example, with many UK local authority pension funds already having investments in property, the ability to exclude property from a multi-alternative solution would have greater appeal to them.

Conclusion

The addition of a well-managed, diversified portfolio of alternative investments should greatly benefit the risk/return profile of traditional portfolios over the long term. As the industry continues to grow at pace, alternative investments will continue to be made more easily accessible. However, the difficulties of integrating alternatives into a traditional portfolio mean that it is crucially important to work with an experienced provider who has a proven long track record in portfolio construction and risk management of multi-alternative solutions.

More Related Content...

|

|

|