|

Written By: Helen Steers |

Helen Steers, Partner and Head of European Primary Investments at Pantheon and current Chair of the BVCA, highlights the trend in the declining number of publicly listed companies, and discusses the key drivers of this phenomenon and the implications for investors

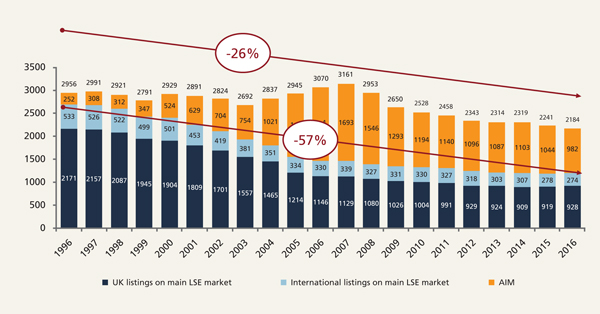

The number of publicly listed companies across global markets has fallen dramatically in the past 20 years. The UK is no exception, where the number of listed stocks has declined by 26% since 1996. In fact, if you delve deeper and exclude the AIM market which expanded significantly in the early 2000s, the main UK market has seen a 57% fall.1 In the US, the number of listed stocks has halved over the same time period.2 The remaining companies are generally older, slower growing and concentrated in a sub-set of sectors. As a result we believe private equity has become increasingly important to complement a public equities portfolio and to enable investors to reach a broader investment universe.

Figure 1: Decline in listed stocks on the UK market

Source: Pantheon Ventures

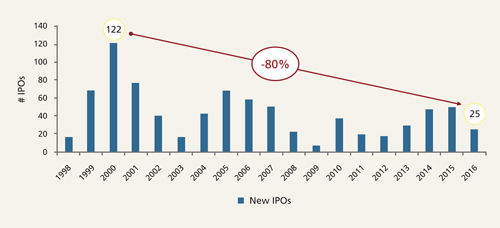

The first obvious driver of this trend is the significant decline in IPO activity. The number of IPOs on the UK main market has fallen by 80% since the turn of the century,3 in part because the traditional benefits of listing, to access capital required to finance growth initiatives and expansion, in many instances no longer outweigh the costs and the increased regulatory burdens. The dearth of IPOs since the listing peak in the late 1990s has reduced the refresh rate of new businesses entering the public market. For instance, in the US the average public company is 50% older and 4x larger than it was 20 years ago. Over the same period, the number of companies in the S&P 500 growing at 20% or greater has halved (from 20% to 10%).4 A combination of robust access to private funding (which has further reduced the net benefit of listing), an increase in take-private transactions and a healthy M&A environment driven by large cash rich corporations, suggests that these conditions are likely to persist.

Figure 2: UK listings on London Stock Exchange main market have seen a large fall since the turn of the century

Source: London Stock Exchange, New Issues and IPO Summary, Accessed September 25, 2017

Increasing access to private market capital has had a profound effect. Total private equity assets under management (unrealised value and dry powder) now hovers at around $2.5 trillion. In 2000 it was just $578 billion.5 So, whilst traditionally public markets were the only source of capital at scale, today that is not the case. In 1996 the median amount raised prior to IPO in the US was just $12 million.6 That figure has grown at 11% per annum to nearly $100 million in 2016, easily within the range of capital that public markets would traditionally provide.7 We believe that access to private funding allows companies to continue pursuing their growth and business objectives without enduring the costs and distractions associated with operating in the public spotlight.

More than ever before, the rapid growth companies experience, and the value for investors created by that growth, is occurring before IPO. Private equity investors have been direct beneficiaries of this trend. The fact that the private equity ownership model includes active, control positions where investors’ interests are aligned with long term value creation is an additional bonus.

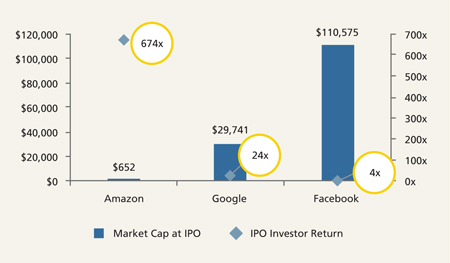

Figure 3 charts the IPO investor returns for three very well-known US companies, Amazon, Google and Facebook, and highlights the impact that time to IPO and market cap at IPO can have on potential for subsequent growth, and the evolution over time. As each company in sequence remained private for longer, by the time of IPO they had achieved greater scale both by revenue and market cap, and we believe the impact on revenue growth and potential for returns is apparent. Facebook was able to raise $2.84 billion of private funding and subsequently IPO at over $100 billion in 2012, eight years after its founding. This makes it inconceivable that an IPO investor in the company could replicate the returns of an earlier investor in Amazon’s IPO, which occurred in 1994 just three years after the company was founded. Notionally, Facebook would need to have reached a ~$70 trillion market cap and Google would need to reach a ~$16 trillion market cap to match Amazon’s return since IPO.

Figure 3: IPO investor returns

Source: Mauboussin, Michael J., Dan Callahan, CFA, and Darius Majd. The Incredible Shrinking Universe of Stocks: The Causes and Consequences of Fewer U.S. Equities. Report. Global Financial Strategies, Credit Suisse. March 22, 2017

There are similar cases of European companies staying private for longer and generating rapid growth pre-IPO, benefiting from multiple rounds of private funding. Some well-known examples include food delivery service, Just Eat, which listed in 2014, 13 years after it was founded; Games developer, King.com, which took 11 years to go public also in 2014; and Skyscanner, which was founded 14 years before it was sold to a strategic buyer in 2016. All these companies generated very strong returns for their private equity backers. We continue to see further fast growing European unicorns that are still privately owned, such as Spotify (founded in 2006), FundingCircle (2010) and Deliveroo (2013).

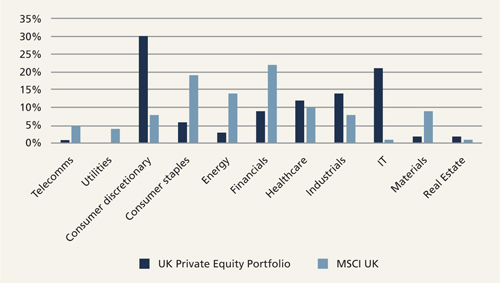

Increasingly, private equity not only provides the opportunity for investors to benefit from the fastest growth phase for successful companies, it also provides vital balance to a portfolio both in terms of company size and industry sector. 87% of the UK public market value is concentrated in companies with market caps of more than €2 billion. The contrast with Pantheon’s private equity portfolio is stark. 89% of the cost in UK headquartered companies across Pantheon’s portfolio is in equity investments of below €1 billion and 67% is below €250 million. Additionally, both public and private equity universes are skewed to certain sectors, and therefore building exposure across both is important to developing a balanced portfolio. To put this into context, the UK public market has a bias towards Financials (22%), Consumer Staples (19%) and Energy (14%).8 Pantheon’s UK private equity portfolio includes 21% in IT and 30% in Consumer Discretionary, both generally faster growing sectors. The UK public market has just 1% in IT.

Figure 4: Sector weightings

Source: UK Private Equity Portfolio is Pantheon’s European portfolio invested capital in UK companies by sector calculated from proprietary database observations of underlying UK investments in Pantheon European portfolios; MSCI UK sector weightings as disclosed in the 31 August, 2017 index factsheet

We believe the public market no longer offers the breadth of investment opportunities that it used to, and so investors face the need to consider alternatives to access younger companies with the potential for more rapid growth. Private equity therefore has an important role to play in complementing listed equity exposure; and as a means to access the full range of investment opportunities and in order to build a balanced and well-diversified portfolio.

1. London Stock Exchange, Market Factsheets pre-2005 and 2005-2016, accessed 25th September 2017.

2. Doidge, Craig, G. Andrew Karolyi, and René M. Stulz. “The U.S. listing gap.” Journal of Financial Economics 123, no. 3 (2017): 464-87. doi:10.1016/j.jfineco.2016.12.002.

3. London Stock Exchange, New Issues and IPO Summary, accessed 25th September 2017.

4. S&P CapitalIQ data accessed 31st March 2017

5. 2017 Preqin Global Private Equity & Venture Capital Report.

6. WilmerHale 2016 IPO Report.

7. “Rebuilding the IPO On-Ramp: Putting Emerging Growth Economies and the Job Market Back on the Road to Growth.” Issue brief. IPO Task Force. 20th October 2011.; WilmerHale 2016 IPO Report

8. MSCI UK sector weightings as disclosed in the 31st August 2017 index factsheet

More Related Articles...

Published: October 1, 2017

Home »

Alternative Investments