The tangible benefits of ESG for Emerging Markets investors

|

Written By: Stephen Hearle |

Stephen Hearle of Nordea Asset Management UK considers the benefits of a well-executed ESG approach as a risk-reduction tool, exemplified by a case study of the effects on the market of Russia’s invasion of Ukraine

ESG and sustainable investing have become widespread among mainstream asset managers. The increasingly obvious impacts of climate change and widening social disparities are leading investors to consider whether – and how – their investments have a role to play. Regulation is also driving both asset managers and investors to greater sustainability. However, while it seems self-evident that responsible investment practices benefit the world around us – and thus stakeholders in general – it is still worth looking at the tangible impact on investment returns that sustainable investment approaches could, and do, have.

Investors must consider the sustainability challenge

While pension fund regulations and guidelines around sustainable investing, such as the Stewardship Code, are expected to bring about higher long-term returns for the funds’ investors, the short-term effects of sustainable approaches can muddy the waters. In 2020, as pandemic lockdowns sent energy prices into free-fall, sustainable funds – many of which are structurally underweight the energy sector – performed very strongly. This year, these drivers have reversed as war in Ukraine has driven up oil and gas prices. As a result, many sustainable funds have seen their performance hit hard. This could lead investors to question the financial impact ESG investment approaches are having on their funds.

For investors who are now worrying whether sustainable approaches really do represent their fiduciary duty, research has demonstrated that investing sustainably can bring financial benefits. A 2019 report by the Morgan Stanley Institute for Sustainable Investing¹ concluded that in the years 2004-2018, sustainable funds performed in line with traditionally-invested funds but saw lower volatility, especially as regards to downside risk. In effect, the sustainable funds generated better risk-adjusted performance. This was also the conclusion of a meta-analysis carried out by NYU Stern Center for Sustainable Business and Rockefeller Asset Management². But in these challenging times, the question is: does this still hold?

In this article we will look more closely at the role of ESG as a risk-reduction tool for fixed income, looking at the recent Russian bond default as a case study.

ESG in fixed income

For many years now, ESG analysis has focused on equities. More recently, however, as investor interest in sustainable investing has grown, asset managers have started to develop Responsible Investment (RI) methodologies for fixed income assets. For corporate bonds, managers typically carry out their ESG analysis at the issuer level, which means that corporate bond investors can utilise the same approaches as equity investors. Sovereign bonds, however, come with challenges: how do you assess the ESG performance of a sovereign issuer, in other words, a country? How do you even decide which criteria are relevant, given that countries do not operate in the same way that companies do? The UNPRI set up a working group – the Sovereign Debt Advisory Committee – comprising representatives of a number of leading asset managers to examine exactly this sort of question and to develop some market best practices.

We can all come up with our own ideas of what a sustainable investment might look like, but it is important to consider what kind of asset we are talking about. Equities can benefit directly from a competitive advantage resulting from higher ESG standards, and therefore equity investors may use the spectrum of ESG performance to make a positive selection of ESG leaders. In fixed income, however, such a competitive advantage feeds through as a lower risk of default and this effectively leads to bond investors using ESG performance to avoid losers.

With this in mind, for fixed income investors to make full use of ESG as a risk-reduction tool, it becomes increasingly relevant for bond investors to consider not only what ESG factors they care about, but also which ones will have the greatest impact on the issuer’s credit risk.

What should a sovereign ESG methodology include?

While potential ESG criteria for corporates are often quite obvious – elements such as a company’s carbon emissions and how it is handling them, its approach to pollution or recycled materials, its management of employee rights and its board composition – it isn’t so easy to see what is appropriate to consider for government borrowers. The best way to make sure we are focusing on the most relevant ESG factors is to examine the correlation between different ESG elements and sovereign bond spreads.

A robust sovereign bond model would be built on these relationships, identified and supported by academic research. While such a process will place issuers along a spectrum, the issuers then need to be split into investable or non-investable to reflect the binary outcome the bond managers need. Nevertheless, there could be sub-categories that reflect the ESG direction each issuer is moving.

Let’s consider how such a methodology held up during Russia’s invasion of Ukraine, looking first at the impact on the market and then how the methodology coped with it.

The recent Russian debt default

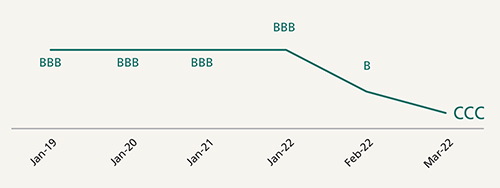

The sanctions imposed on Russia following its invasion of Ukraine in February 2022 have limited Russia’s access to foreign currency. June 27 marked the end of a 30-day grace period for the payment of $100 million interest on two Russian bonds and the date when rating agencies officially considered the bonds to be in default. The default was well-anticipated, with bonds already having been sharply de-rated, as shown in Figure 1.

Figure 1: Rating trend

Source: S&P Global Ratings

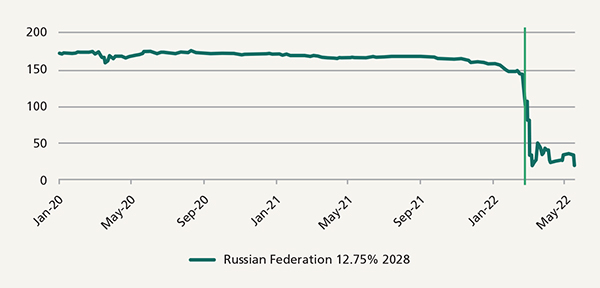

Figure 2 shows how sharply Russian bond prices fell in expectation of the de-rating and eventual default.

Figure 2: Russian bond sell off

Source: Bloomberg L.P. as of 03.06.2022

The question an EMD investor will have been asking himself over the recent months is whether any of this was predictable. Did you expect Russia to invade Ukraine? Probably not. So how could any investor hope to avoid this situation?

How would an ESG model capture war – before it even happens?

In the beginning of 2020, it was apparent that Russia was becoming increasingly aggressive on the international stage, with particular concerns following the attempt to poison the former Russian intelligence officer Sergei Skripal. Later in 2020, the poisoning of opposition leader Alexey Navalny and new reports that substantiated accusations of Russia’s interference in US elections raised additional flags from a geopolitical angle.

While we can all agree that poisoning one’s critics and illegally influencing other countries’ democratic processes is “wrong”, how can these behaviours be captured in a ESG model?

Unsurprisingly, Governance is the ESG topic most widely covered in the literature around ESG for sovereign bonds, and analysis indicates it is Governance (as opposed to Environmental or Social issues) that has the greatest impact on a country’s credit-worthiness. Here we are talking about aspects such as the basic principles of democracy – things like human rights, the right to vote, and having institutions stable enough to allow democracy to survive. On top of that we need to consider the implementation of those democratic principles, such as an organised legislature and judiciary to uphold citizens’ rights, and the presence of corruption or other destabilisers of business. These might seem quite obvious, but it is not so obvious how to break these down into quantitative indicators that can drive an ESG model. We have built and backtested a sovereign ESG model like this that monitored and quantified these elements, and that detected the deterioration in Russia’s position on the global stage.

Prior to its exclusion in March 2022, Russian government debt represented 0.89% of the EM Debt benchmark. In Q1 2022, Russian debt fell sharply, thereby contributing a negative 342 basis points (-3.42%) of performance to the overall index return. Any fund that had correctly decided to exit Russia ahead of the fall would have thereby avoided that fall and therefore that decision alone would have contributed +342bps of relative performance to the fund.

Not every example of ESG’s role as a risk-reduction tool is as clear-cut as this one, but this recent and real example does highlight how tangible the benefits of a well-executed ESG approach can be.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

1.https://www.morganstanley.com/pub/content/dam/msdotcom/id

eas/sustainable-investing-offers-financial-performance-lowered-risk/Sustainable_Reality_Analyzing_Risk_and_Returns_of_Sustainable_Funds.pdf

2.https://www.stern.nyu.edu/sites/default/files/assets/documents/

NYU-RAM_ESG-Paper_2021%20Rev_0.pdf

More Related Content...

|

|

|