Three reasons for allocating to emerging market equities

|

Written By: Roger Merz |

|

Anthony Corrigan |

Roger Merz and Anthony Corrigan of Vontobel Asset Management spell out their reasons for believing that emerging market equities are on the road to recovery

Emerging market (EM) equities have trailed their developed market (DM) counterparts for the past 10 years; lower earnings growth have been the main driver of this underperformance. However, there are three key reasons we believe an allocation to EM equities offers attractive opportunities to investors keen to follow an active approach.

Reason 1: Valuation is compelling

For many of us, this is the most complex market environment we have experienced in our working lives. Spiralling levels of inflation, conflict in Europe, and a cost-of-living crisis sparked by soaring energy bills: these events are not unprecedented, but they have not impacted us for a considerable period, let alone at the same time. Amid the market chaos, it can be difficult to stand back and consider the fundamentals. However, let’s take a moment to do just that and, given that an investor’s entry point will ultimately determine how profitable their investment turns out to be, there is no better place to start than valuation.

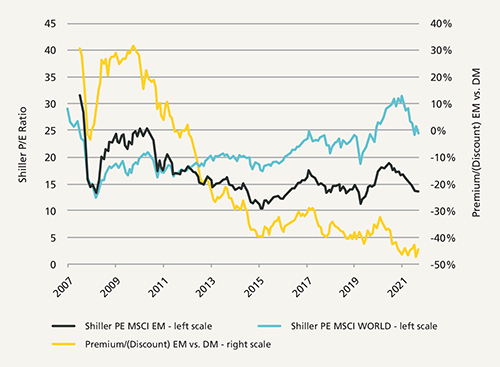

It is hard to believe that EM equities once traded at a significant premium to developed markets, but that is exactly what happened at the end of the commodities super cycle from 2000-2011. That premium has since evaporated and the asset class now trades at a 44% discount to DM equities based on Shiller P/E – the cyclically adjusted price-to-earnings ratio which adjusts 10 years of earnings for inflation. While Shiller P/E holds no predictive power for returns over the short term, the ratio can be a powerful indicator of long-term returns and as such should not be ignored.

Figure 1: EM equities trade at a significant discount to developed markets

Source: Vontobel Asset Management, Bloomberg, Factset; data as of 31 August 2022

Reason 2: Uplift in Asian earnings and GDP growth

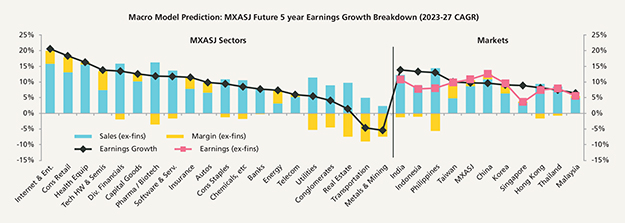

EM equities represent compelling value on a relative basis for a good reason. In general, earnings growth for EM companies have been much weaker in comparison to developed market companies. For example, earnings growth for the MSCI Asia ex Japan index fell from 13% during 2000-2010 to 7% during 2011-2021, while earnings growth for the S&P 500 were in excess of 20% over the same period. This begs the question: What happens to earnings going forward and what impact could this have on returns?

An earnings model devised by Goldman Sachs, which analyses fundamental data by sector and macro data by country, estimates that earnings growth in Asia could increase to 10% p.a. over the next five years. This would represent a considerable increase in earnings from the 2011-2021 period, which could spur a period of valuation expansion for Asian equities, which in turn would lift global emerging markets.

Supporting this potential growth in corporate earnings is the forward-looking differential between emerging and developed market real GDP growth. While this differential is estimated to fall below 1% in 2022, it is expected to widen again significantly in 2023. According to J.P. Morgan estimates, real GDP growth in emerging markets could grow to 3.2% in 2023 compared to just 0.9% for developed markets. This widening of the growth differential is emanating from China and EM Asia, which are expected to grow by 4.6% and 4.1% in 2023 respectively.

Figure 2: How Asian earnings could change in the coming years

Source: The Asian earnings enigma. Goldman Sachs, September 11, 2022

Reason 3: Moving from “out of favour” would mean significant inflows

Finally, emerging market equities are currently under-represented in the average investor’s portfolio. According to JP Morgan, global investors currently allocate 6.4% to EM equities, which is significantly below the 20-year average of 8.9%. A change in sentiment and reversion to this long-term average would represent inflows of almost US$750 billion. Investors moving to a neutral or overweight position to EM equities earlier than the herd would obviously reap more reward should such a reversal in sentiment take place.

Conclusion

Investors in EM equities have endured a difficult 10 years. However, as investors we need to look forward and there are reasons to believe that the asset class is set for a brighter next chapter. Relative valuations appear attractive while earnings are potentially set to rebound in Asia at the same time as GDP growth will be much faster than in the developed world. Given these factors, and the fact that EM equities are currently underweight in the average investor’s portfolio, we believe emerging market equities are on the road to recovery and any further short-term pain will be outweighed by the opportunity for longer-term gain.

Disclaimer

This marketing document was produced by one or more companies of the Vontobel Group (collectively “Vontobel”) for institutional clients and is for information purposes only and nothing contained in this document should constitute a solicitation, or off er, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever.

Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, up-loaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel Asset Management AG (“Vontobel”). To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this document must not be distributed or handed over to US persons and must not be distributed in the USA.

More Related Content...

|

|

|