Using MAC to make the most of a low-yield environment

|

Written By: Kevin Kearns |

|

Tom Fahey |

|

Roger Ackerman |

Kevin Kearns, Tom Fahey and Roger Ackerman of Loomis Sayes show how a robust approach to multi-asset credit strategies could help investors preserve capital while capturing the credit risk premium over market cycles

In a low-yield environment, fixed income portfolios concentrated in core assets such as Gilts and investment grade bonds may fall short because they assume a singular risk profile and lack a yield cushion. We believe investors should consider multi-asset credit strategies for exposure to diversified sources of income and attractive risk-adjusted return potential.

What is MAC?

Multi-asset credit (MAC) is a diversified investment discipline that aims to capture global credit risk premiums by investing in a range of geographies, asset classes and credit instruments. MAC strategies can exploit broad macroeconomic trends, changing global credit conditions and individual security selections to pursue these goals.

How does MAC work?

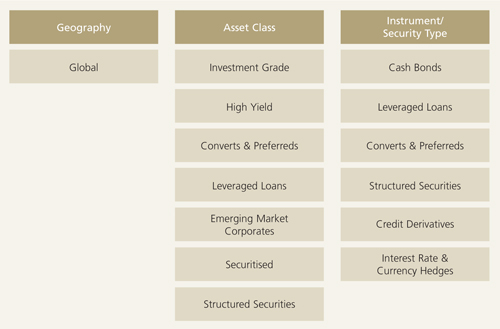

Credit strategies provide a way for investors to lend capital to borrowers. The investor’s goal is to earn an attractive return and receive the capital back at the end of the term. MAC strategies broaden the opportunity set beyond government bonds, which are generally considered the highest-quality fixed income securities, and enable investors to lend across a diverse set of geographies and quality grades. MAC disciplines actively search for attractive risk-adjusted premiums above typical government bond yields. A risk premium is additional yield that serves as compensation for assuming increased exposure to risk factors like credit and liquidity. MAC investors have the potential to earn significantly higher income and total return than they could with, for example, a government-, local- or investment grade-only strategy in exchange for exposure to these and other risk factors. As shown in Figure 1, MAC portfolios can access a range of global asset classes and investment instruments.

Figure 1: Investment opportunity set

Source: Loomis Sayles

MAC investing and the credit cycle

MAC investing tactically allocates capital to regions, countries and sectors. Making the most of this dexterity demands a deep understanding of the credit cycle.

What is the credit cycle?

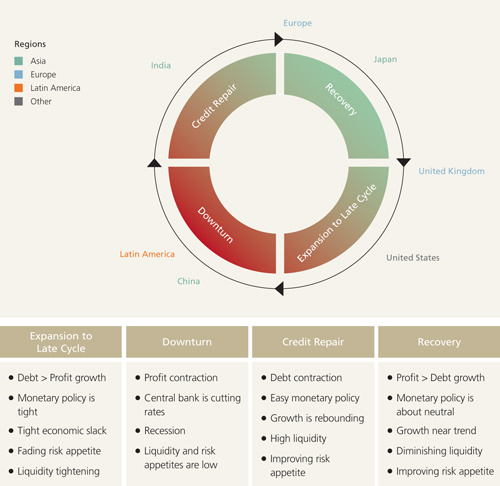

The credit cycle is a disciplined top-down framework used to analyse changing credit conditions over time. Credit cycle analysis tracks which economies are borrowing and spending, and which are saving and deleveraging. The cycle has four major phases: expansion to late cycle, downturn, credit repair and recovery. Regions, countries and sectors around the world are all in different phases of the credit cycle at any given time, which can create potential credit opportunities over a full credit cycle.

Figure 2: The credit cycle framework helps analyse changing credit conditions

Source: Loomis Sayles. Views as of 31 December 2015

MAC investing through the cycle

Because individual regions, countries and sectors chart their own course through the credit cycle, formulating a distinct credit cycle view for each is essential. Defaults typically begin to rise in the expansion to late cycle phase and peak during downturn, and the credit risk premium follows the same pattern. MAC strategies are designed to monitor country, sector and security default patterns; portfolio managers use their credit cycle views to assess relative value opportunities and determine optimal portfolio positioning. We consider this versatility a key advantage of MAC investing.

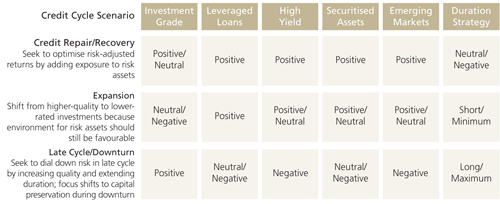

Figure 3 demonstrates our belief that sectors follow fairly dependable patterns of behaviour throughout each phase of the credit cycle. In our view, a credit cycle framework combined with a deep understanding of valuations (the degree of over- or under-value relative to other sectors and history) and technical factors (for example capital trends and seasonalities) can help promote strong fundamental risk management and performance potential.

Figure 3: Sector behaviour throughout the credit cycle

Source: Loomis Sayles

Uncovering individual credit opportunities

In addition to potentially harvesting credit risk premium through geographic and sector allocations, MAC strategies can take advantage of individual credit opportunities. Deep, specialised research expertise that cuts across markets is a requisite for any credit strategy. Fundamental security analysis can uncover issues trading at a discount to their intrinsic value. Individual credit selection can be particularly important during the later stages of credit cycle downturns and heading into credit repair, when widespread risk aversion tends to punish risk assets indiscriminately. Fundamentally sound credits purchased at a discount during these cycle phases may experience price appreciation as the cycle progresses, which can help boost returns.

Duration management

Duration risk, the sensitivity of bonds to changes in interest rates, is an inevitable part of credit investing. Because MAC strategies are designed with broad discretion across the credit spectrum, having the tools available to more effectively manage duration risk is critical. For example, high yield credits can sometimes increase in value during economic expansions, but an associated rise in interest rates can offset that price appreciation. To address scenarios like this, we advocate allowing MAC strategies to actively manage duration.

Why have a MAC allocation?

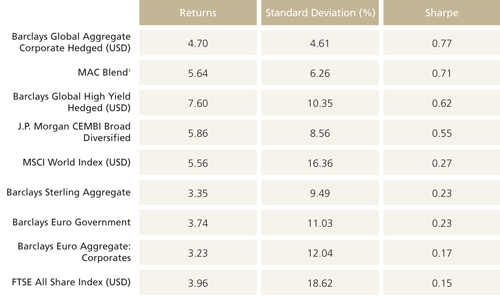

MAC portfolios can be managed to capture opportunities based on the global credit cycle, economic conditions and a plan’s stated risk tolerance. MAC disciplines cast a wide net in the global search for yield, giving investors access to a mix of investment grade, high yield, convertibles, emerging markets, leveraged loans and securitised issuers. By focusing on sectors that offer an attractive risk-adjusted spread over government bond yields, MAC investing may boost return potential. For example, diversification has helped the MAC Blend shown in Figure 4 achieve higher returns with lower volatility than most major single asset classes for the ten years ended 31 December 2015. This favourable return/volatility profile also supported a strong Sharpe ratio, which measures risk-adjusted returns, for the same time period.

Figure 4: Diversification potential

Source: eVestment Alliance, data for the 10 years ended 31 December 2015. Results are shown in US dollars. Returns are annualised. Standard deviation measures return dispersion. Past performance is no guarantee of future results. Data as of 31 December 2015

Figure 5: Sharpe Ratio – 10-year annualised data as of 31 December 2015

Source: eVestment Alliance, data for the 10 years ended 31 December 2015. Results are shown in US dollars. Returns are annualised. Sharpe ratio measures risk-adjusted return by dividing return in excess of the risk-free rate by volatility. Past performance is no guarantee of future results.

For investors already deploying assets to credit, this diversification broadens the base of opportunities to include asset classes less correlated to core investments. While diversification does not protect against loss, it can help reduce portfolio risk. The dynamic nature of the strategy may also give plan sponsors a lens into the global credit cycle, potentially informing them of risks in their overall plan. Managing duration and, if needed, currency exposure can improve return potential and risk management. Managers can use these levers separately in their efforts to optimise overall portfolio positioning.

Conclusion

Active investing across global geographies and multiple bond sectors is complex work. Careful investment manager selection is critical to harnessing the benefits of the strategy. MAC managers should have experience steering multisector portfolios through a range of market cycles. We believe practical experience combined with a systematic investment process that is designed to identify business and default cycles can provide opportunity to effectively preserve capital and capture the credit risk premium over market cycles. Robust fundamental research and integrated risk capabilities are essential inputs that may further support return potential. Finally, MAC managers must understand a scheme’s risk tolerance and duration objectives and tailor their approach accordingly.

Important information

Indexes shown in charts and graphs were selected to represent global credit sectors on which multi-asset credit strategies can potentially draw as well as the global and UK equity markets and core UK fixed income. All indexes are unmanaged and do not incur fees. It is not possible to invest directly in an index.

The hypothetical MAC Blend is a blend of indexes created by Loomis Sayles World Credit Asset team and shown for illustrative purposes only. The MAC blend consists of 50% Barclays Global Aggregate Corporate Index – USD Hedged, 25% Barclays Global High Yield Index – USD Hedged, 15% JP Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified, 10% S&P/LSTA Leveraged Loan Index.

Standard deviation measures return dispersion. Sharpe ratio measures risk-adjusted return by dividing return in excess of the risk-free rate by volatility.

This data and analysis does not represent the actual or future performance of any investment product and it is subject to change. These results do not reflect the impact of actual portfolio trading and do not reflect the deduction of fees and expenses and assume the reinvestment of dividends and capital gains.

Past market experience is no guarantee of future results.

Diversification does not ensure a profit or protect against a loss.

There is no guarantee that any investment objective will be realized or that the strategy will generate positive or excess return.

Key Investment Risks: Non-US Securities and foreign investments involve special risks including greater economic, political and currency fluctuation risks, which may be even greater in emerging markets. Currency risk is the risk that fluctuations in exchange rates between the U.S. dollar and foreign currencies may cause the value of a portfolio’s investments to decline. Credit risk is the risk that the issuer or borrower will fail to make timely payments of interest and/or principal. This risk is heightened for lower-rated or higher yielding fixed income securities and lower rated borrowers. Liquidity risk is the risk that the portfolio may be unable to find a buyer for its investments when it seeks to sell them, which is heightened for high yield, mortgagebacked and asset-backed securities. Other risks include issuer, interest rate, derivatives, leverage, counterparty, prepayment and extension risk. Investing involves risk including possible loss of principal.

This paper is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice.

Loomis Sayles Investments Limited, a subsidiary of Loomis, Sayles & Company, L.P., is authorised and regulated by the Financial Conduct Authority.

Loomis, Sayles & Company, L.P. is an investment adviser registered with the US Securities and Exchange Commission and is authorized to provide investment management services in the United States.

MALR014960

1. The hypothetical MAC Blend is a blend of indexes created by Loomis Sayles’ World Credit Asset team. Please see endnotes for a more detailed description of the benchmarks and the MAC Blend. This is for illustrative purposes only and does not represent any Loomis Sayles investment product. Other industry analysts and investment personnel may have different views and opinions.

More Related Content...

|

|

|