Sustainable development in EM – what contribution can companies make?

Published: February 22, 2023

Written By:

|

Raphael Lüscher |

|

Antoine Hnein |

Raphael Lüscher and Antoine Hnein from Vontobel discuss how to identify emerging market companies that are most aligned to SDGs, and how investment in them can offer superior growth potential while furthering the UN’s sustainable development agenda

The global importance of environmental, social and governance (ESG) standards is rising, supported by an increased focus of sustainability-minded equity investors looking for investments beyond their home turf. We strongly believe that, whilst economies strive towards a more sustainable future, investors should consider companies that are aligned with the objectives of the United Nations (UN) Sustainable Development Goals (SDGs).

According to MSCI Research¹ and IEA, emerging market countries not only contribute more towards global warming but also face higher physical risks. Therefore, it is inevitable to address these obstacles in order to achieve a more sustainable future. The SDGs are a universal call-to-action to address the world’s most pressing long-term challenges from poverty alleviation, universal healthcare, climate action, education, inequality, economic growth and more. The SDGs provide a shared blueprint for peace and prosperity for all people and the planet, with the private sector playing an important role in advancing these goals. We believe that identifying what we at Vontobel call “sustainability champions” presents an attractive investment proposition as it helps investors preserve the long-term value of their assets while actively contributing towards solutions for these sustainability challenges.

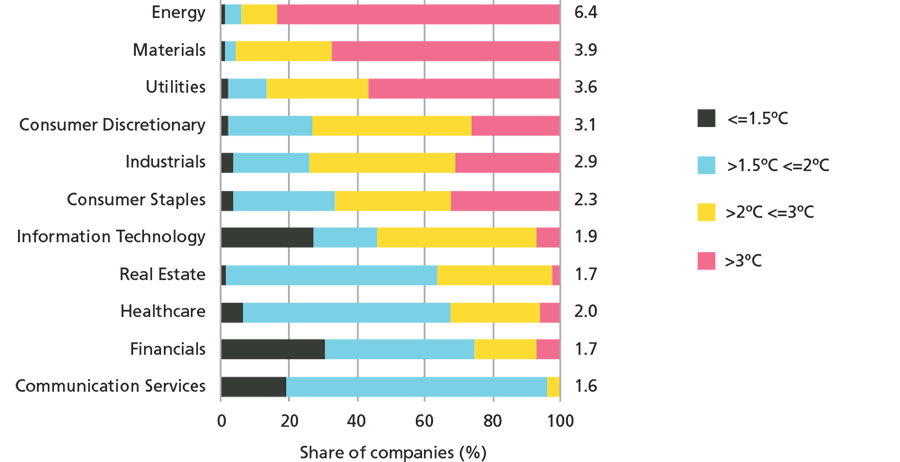

Figure 1: MSCI EM Index on track for potential 3.7° warming vs 2.8° in DM

Source: Vontobel Asset Management, MSCI ESG Research https://www.msci.com/www/blog-posts/why-your-portfolio-may-be-hot/02963484685 (January 2019), IEA (June 2022)

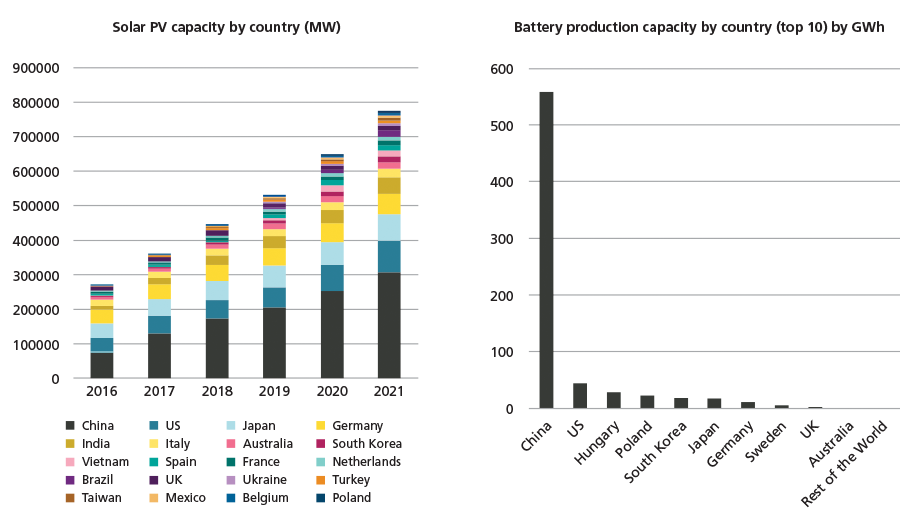

While emerging markets are one of the major contributors to global warming, they also hold the key to many of the solutions to help mitigate it. For example, the solar photovoltaics capacity of China is much larger than in many industrialised countries and is growing at a much higher rate. Additionally, battery production capacity in China measured in GWh is 10x higher than in the US.²

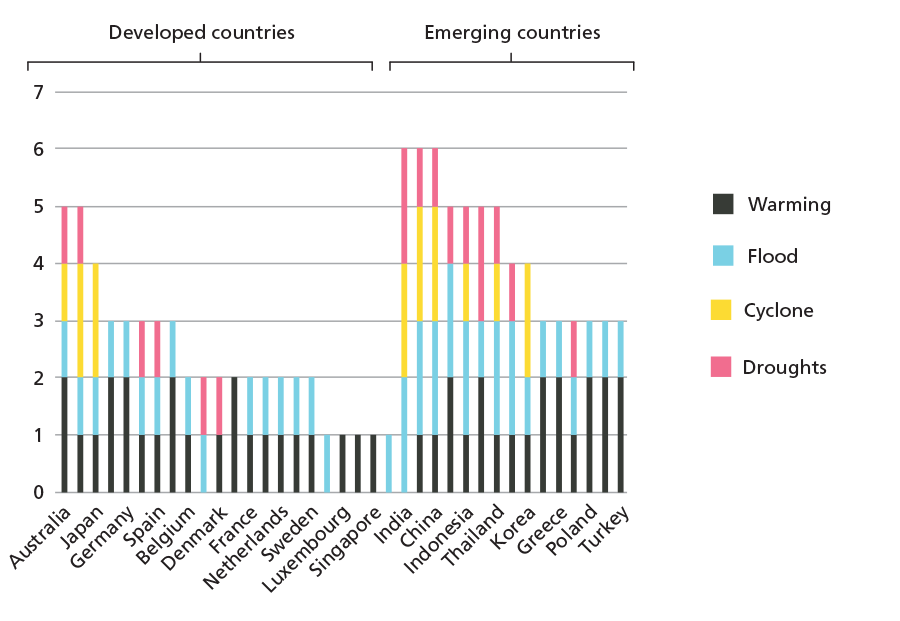

Figure 2: Aggregated level of climate hazard for IEA member countries

Source: Vontobel Asset Management, MSCI ESG Research https://www.msci.com/www/blog-posts/why-your-portfolio-may-be-hot/02963484685 (January 2019), IEA (June 2022)

Figure 3: Solar PV capacity by country and Battery production by country

Source: Vontobel Asset Management, IEA (October 2022), S&P Market Intelligence (February 2021)

It is estimated that a gap of over US$4 trillion pa. of funding is needed to meet the SDGs. Further, the delivery of the SDGs could create specific business opportunities worth over US$12 trillion pa. and up to 380 million jobs by 2030, with nearly half of these new jobs and more than half of these investment opportunities in emerging markets.³

We believe that companies which actively engage on ESG issues tend to have more sustainable shareholder returns and be better at managing their real-world impacts. By integrating sustainability considerations into our investment processes, we enhance the risk profiles of our portfolios and select companies for their ability to manage their real-world impacts.

- Mitigate financial risks: Companies that actively engage on ESG issues tend to have better risk management, enabling more sustainable levels of shareholder returns.

- Minimise harm: Companies can reduce harm to the environment and society (externalities) through the way they do business.

- Contribute positively: Companies can contribute to the improvement of society and the environment through the nature of their products and services.

Identifying sustainability champions

As the UN SDGs are designed for countries and not for companies, a subjective interpretation is required to translate them into an investment framework with concrete key performance indicators (KPIs) against which companies can be evaluated for portfolio inclusion. For example, we screen stocks according to three principles: 1) a significant contribution to at least one of the UN SDGs, 2) a detailed evaluation of their ESG operational performance, and 3) compliance with extensive exclusion criteria set to avoid economic activities that are harmful to society or the environment.

At Vontobel, the first two requirements cited above are based on independent and proprietary frameworks: the SDG assessment and the minimum standards framework (MSF).

In our opinion, the SDG assessment should look into companies’ revenues. For this, we use FactSet data to determine their potential alignment to any of the UN SDGs. In a second step, companies are subject to fundamental research analysis, which should take a closer look into the sources of revenues and services to provide more granularity around the nature of the business, supply chains, end markets and geographic skews. Finally, ESG analysts should undertake a final and detailed qualitative assessment around the relevance of these revenues to the various SDG sub-goals.

Furthermore, we believe it is important for companies to manage their sustainability risks proactively and engage on material ESG issues. This ESG analysis needs to be fully integrated into the company evaluation to reach decisions based on a comprehensive understanding of each company. We find that active investors with in-house ESG expertise can add real value in differentiating what is financially relevant from irrelevant ESG noise. Additionally, a direct dialogue with companies to overcome information gaps is critical, particularly in emerging markets where information from data providers might be limited or missing.

Demographic megatrends are shaping a new world order

Demographic shifts are posing new challenges and opportunities and are consequently reshaping global supply chains and partnerships. Indeed, structural trends, such as an aging, urbanised population with mobility needs, are changing the nature of “how, who and where” production is taking place.

Such trends are happening in emerging markets. While it is projected that Africa and South Asia will make up 90% of the rise in the working-age population in the next 20 years, countries in East Asia like China, South Korea and Taiwan are facing ageing/low fertility and declining working-age population with higher dependency ratios and widening inequality. Such demographic shifts have a strong impact on the labour force, migration, new consumption patterns, development of urban cites as well as a strong need for digitalisation, automation, and new infrastructure.

Emerging markets represent the lion’s share of the world’s population and continue to be the driver of global economic growth. They already represent 58% of the world’s economy and the IMF expects emerging economies to grow faster than industrialised countries at an annual rate of nearly 3% for the next five years. By identifying companies that are most aligned to SDGs, investors can take part in a compelling investment proposition with superior growth potential, whilst also helping to progress the UN’s Sustainable Development Agenda.

Disclaimer

This marketing document was produced by one or more companies of the Vontobel Group (collectively “Vontobel”) for institutional clients and is for information purposes only and nothing contained in this document should constitute a solicitation, or off er, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever.

Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, up-loaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel Asset Management AG (“Vontobel”). To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this document must not be distributed or handed over to US persons and must not be distributed in the USA.

1. Source: MSCI ESG Research https://www.msci.com/www/blog-posts/why-your-portfolio-may-be-hot/02963484685 (January 2019), IEA (June 2022)

2. Vontobel Asset Management, IEA (October 2022), S&P Market Intelligence (February 2021)

3. Business and Sustainable Development Commission, Better Business, Better World, January 2017.

More Related Content...

|

|

|