A positive trend of improving governance in emerging markets

|

Written By: Matthew Vaight |

Matthew Vaight of M&G Investments outlines the benefits that can be delivered when including governance criteria in the decision-making process

What is corporate governance and why does it matter? There is no straightforward definition of what corporate governance is. However, it is generally understood that it encompasses the way that firms are organised, how capital allocation decisions are made, how transparent the company is from a reporting perspective and ultimately whether they are focused on delivering returns to all their shareholders.

Corporate governance practices matter because they can have a significant influence on how a potential investment might perform. The whole premise of equity investing is founded upon the idea that providers of capital receive an adequate return on their capital – as shareholders they should participate in the success of the company. A well-run company will typically use investors’ capital sensibly, focusing on generating returns on capital above the cost of capital and thereby creating value. It should also have a strong shareholder focus and seek to generate profits that it can share with shareholders in the form of dividends.

We believe that corporate performance and a firm’s profitability, in particular, determines how the share price will perform over the long run. Therefore, companies that are run profitably in the interests of all their shareholders should enjoy superior long-term stockmarket returns. In contrast, firms where there is no alignment between the management team and the shareholders, where capital is invested inefficiently and where investors do not participate in the success of the company are likely to underperform.

Why is corporate governance important in emerging markets?

When it comes to investing in emerging markets, we believe assessing corporate governance standards should be a core element of the decision-making process because the quality of companies is so varied.

The emerging market universe is extremely diverse and there is a wide gulf between the best and the worst companies. In our view, some emerging market companies are among the best run organisations in the world but there are others with very poor corporate governance standards.

This disparity emphasises the importance of an active, selective approach to investing in emerging markets. It is relatively easy to find cheap companies but unless they are run in the right way, with a focus on delivering returns to their shareholders, it is highly likely that they will turn out to be ‘value traps’, in other words, stocks that are destined to always remain cheap.

One of the most effective ways that emerging market investors can gain trust in potential investments is to assess a firm’s “culture” by engaging with the management team. Company management teams are responsible for setting business strategies and allocating capital to projects. As a result, their decisions and priorities can have a huge impact on a firm’s future profitability. It is therefore essential to establish whether they use capital efficiently to create value for their investors and that there is alignment between the interests of the management teams and shareholders.

Ideally, management’s remuneration packages and long-term incentive plans and rewards should encourage them to run the business in the right way, for example by setting targets based on profitability rather than growth, which would align their interest to those of shareholders.

The challenge of controlling shareholders

One of the biggest issues for emerging market investors is the influence of controlling shareholders, such as the state or founding families, which means that minority investors might not participate in the company’s success.

In China, for example, there are large numbers of state-owned enterprises (SOEs), in which the government retains a majority stake and effectively controls the business. They are particularly prevalent in the banking sector. In our view, state control often means a company will be run for the benefit of the state, focusing on socio-economic benefits rather than maximising returns for shareholders.

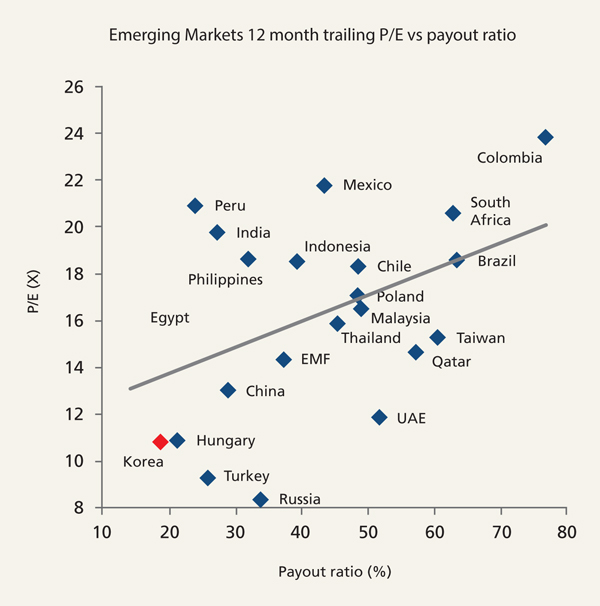

Meanwhile South Korea’s stockmarket is dominated by family-owned conglomerates, known as chaebols. These complex, sprawling businesses are some of the largest companies in the world, such as Samsung Electronics. However, their tendency to focus on the interests of controlling families rather than minority shareholders combined with low dividend payouts have put many investors off. This is arguably why South Korea’s stockmarket has historically traded at a significant valuation discount to other Asian markets (see Figure 1).

Figure 1: South Korea’s stockmarket discount

Source: MSCI, Credit Suisse research, December 2016

There is often a conflict of interest between the controlling shareholders and the minority shareholders. Investors need to be aware of the possibility that their voice and interests could be drowned out by a powerful majority shareholder. Not all SOEs or chaebols are the same, but investors need to be selective and gain confidence that the company is being run for the benefit of all its shareholders.

Positive changes in South Korea

While many investors are wary about South Korea, we believe there are some positive governance trends underway that could transform the potential returns from South Korean firms. International investors and South Korean policymakers have been putting pressure on the chaebols for some time to adopt more shareholder-friendly measures, change their structure and improve their business practices.

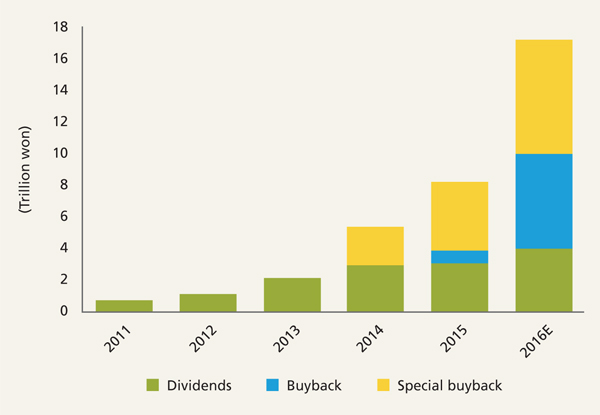

This is starting to deliver results. Dividend payments have risen significantly, although they remain low. Samsung Electronics, arguably the most high-profile South Korean company, has been at the forefront of this change (see Figure 2 below). The firm has embarked on a shareholder return initiative and has said it intends to continue increasing the amount of cashflow it returns to investors over the coming years.

Figure 2: Samsung Electronics’ rising dividends – annual shareholder return

Source: CLSA, Samsung Electronics, December 2016

Recent headlines about a scandal in which a number of the family-dominated conglomerates are alleged to have bought political influence might suggest that chaebols have not changed their ways. On the contrary, the investigation and subsequent arrest of a powerful Samsung executive arguably suggest that the activities of some chaebols will no longer be tolerated.

The scandal could actually be a catalyst for change and potentially accelerate the much-needed restructuring of the dominant chaebols. The scandal has given rise to a slew of proposed bills related to corporate governance with a goal of “economic democratisation”. These would encourage fundamental corporate restructuring and improve minority shareholders’ rights. In our view, these are extremely encouraging developments which could help reduce the South Korean market’s traditional valuation discount.

Multi-decade improvement in corporate culture

We believe the improving governance practices in South Korea are a notable example of the broader changes taking place in emerging markets today. Many investors focus on the long-term structural trends underway in emerging markets but, in our view, the multi-decade improvement in corporate culture is one of the most exciting aspects of emerging markets.

As firms become better run with a greater shareholder focus, we expect the more efficient use of capital to result in increased profitability, and therefore in time, share price appreciation. In our view, this makes emerging market equities an attractive source of opportunities for institutional investors seeking to achieve long-term returns.

For Investment Professionals only.

This article reflects M&G’s present opinions reflecting current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this article does not constitute an offer or solicitation. It has been written for informational and educational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|