Accessing emerging market returns with lower volatility

|

Written By: Martyn Hole |

Investors who treat emerging markets as a single asset class are able to access a broader set of investment options. Martyn Hole of Capital Group explains how investors could take advantage of dynamism and growth in the sector

The long-term case for investing in emerging markets is well established – young populations driving growth, an increasingly affluent middle class, and supportive government policies. Despite recent challenges and a slowdown in growth of some emerging market economies, these markets still offer attractive growth and returns. The fact remains, though, that investing in emerging markets can be a volatile experience. While volatility in emerging market equities has generally declined in recent years, it remains well above that of developed markets, averaging around 24% over the long term (based on annualised standard deviation over 10 years. Source: MSCI EM Index with net dividends reinvested in US dollar terms), compared to approximately 16% for developed markets (source: MSCI World Index with net dividends reinvested for 10 years in US dollar terms).

Emerging markets multi-asset: a lower risk approach to investing

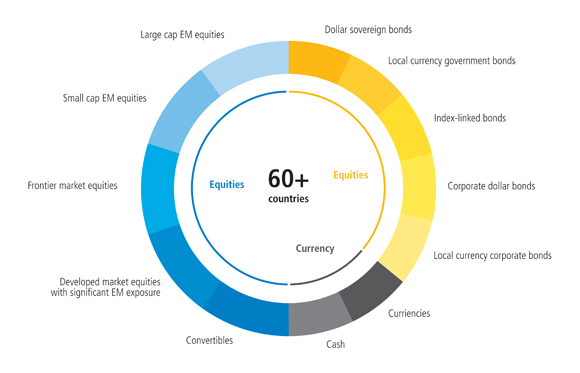

Over the last few years, emerging markets multi-asset (EMMA) has become a more widely recognised strategy that has gained interest from local government pension schemes. Strategies of this type typically seek to deliver a better balance of risk and return compared to an emerging market equity-only investment, by investing across the entire spectrum of emerging markets.

Broadening the investment universe to include emerging market debt, currencies and convertibles allows managers to dampen emerging market equity volatility, without sacrificing returns, as well as allowing for greater diversification within the portfolio.

An EMMA strategy can achieve a variety of different goals, depending on what an investor is trying to accomplish. Strategies of this nature may appeal to investors who want dedicated exposure to emerging markets but are not comfortable with the volatility typically associated with emerging market equities. An EMMA approach can also serve as a complement to other emerging market strategies, and can provide a diversified source of return without using a large portion of an investor’s risk budget. This type of strategy has historically exhibited different risk-return patterns compared with dedicated emerging market equity or debt strategies.

Figure 1: Range of opportunities that may be accessed through an EMMA strategy

The importance of a lower risk approach to emerging markets

Over a market cycle we believe that treating emerging markets as a single asset class has the potential to offer an attractive risk/return profile, and provide downside protection in difficult markets.

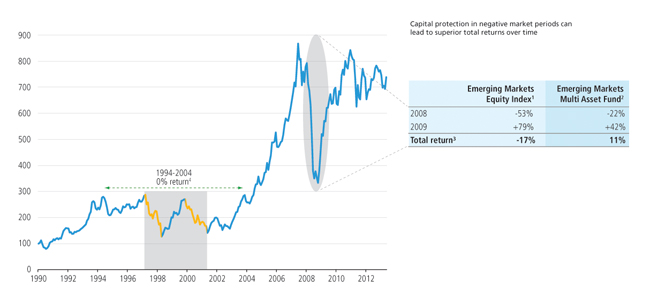

Figure 2 shows the returns of emerging market equities from 1990 onwards. As can be seen, long-term returns can be destroyed by large declines in the asset class, such as those witnessed between 1994 and 2004.

The table highlights the downside protection an EMMA approach can provide in difficult market conditions for emerging market equities. During the market downturn in 2008, emerging market equities declined by more than 50%, while the EMMA approach was down by less than half that amount in absolute terms.

When the market recovered, the EMMA approach lagged. But over that two-year cycle, emerging market equities were still in negative territory, while the EMMA approach delivered positive returns.

Figure 2: Emerging market equity index from 31 May 1990 onwards

1. MSCI Emerging Markets Index with net dividends reinvested from 31 Dec 2000. Previously MSCI EM with gross dividends reinvested. Source: MSCI

2. Emerging Markets Multi Asset Fund Composite before management fees and expenses. Source: Capital Group

3. Total return is calculated geometrically. Source: MSCI/Capital Group

4. Over the 10 year period for 30 Sep 1994 – 30 Sep 2004

Data as at 30 September 2013.

A bottom-up versus top-down approach to EMMA

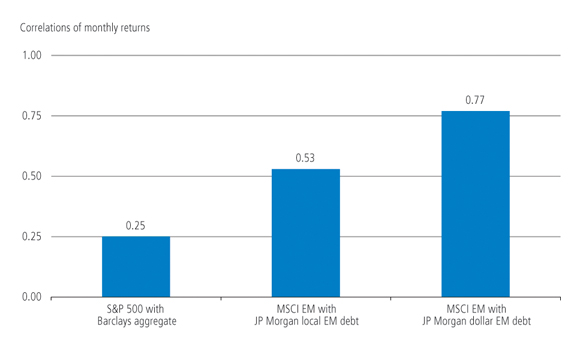

Unlike the US where equities and bonds have a relatively low level of correlation, emerging market equity and debt markets are highly correlated (see Figure 3), showing that they

are similarly influenced by macroeconomic and market forces. This high correlation can prove problematic for strategies that aggregate emerging market equities and bonds from the top down, rather than on a bottom-up basis.

Employing a top-down approach can result in overexposure to countries and sectors that dominate the emerging market equity and bond indices. For example, Brazil is a significant component of both the emerging market equity universe, and the emerging market fixed income universe. A “bolt together” portfolio would almost inevitably lead to overexposure to Brazil.

Implementing portfolio decisions at a security level provides greater flexibility, and the potential to create a more diversified portfolio. This approach means an investor can make a deliberate decision about investing in Brazil, and how to make that investment in the most attractive way from a risk/return point of view.

Figure 3: Correlation of equity and bond returns

1. Indices are S&P 500 Total Return Index, Barclays Aggregate Bond Total Return Index

2. MSCI Emerging Markets (with net dividends reinvested) and JP Morgan GBI-EM Global Diversified Total Return Index

3. MSCI Emerging Markets (with net dividends reinvested) and JP Morgan EMBI Global Total Return Index

Source: Barclays, MSCI, JP Morgan and S&P 500. Period shown is 31 October 2008 to 31 October 2013

Pulling equity and bond levers for an efficient emerging markets portfolio

Broadening the investable universe of an emerging markets portfolio to both equity and debt provides investors with greater choice to invest in different market conditions. This broader set of choices allows skilled investors to pull levers that can ultimately lead to a portfolio that can achieve equity-like returns over a full market cycle, but with significantly lower volatility.

Lever 1: Investing across the capital structure – corporate stock and debt

Allowing an investor to invest across a company’s capital structure provides flexibility depending on the market environment. One can decide to own the equity to access growth, or the bond to receive a coupon payment and capital appreciation, if it is an improving asset, or to dampen volatility in a portfolio.

Lever 2: Capturing themes beyond the “obvious” investment

Taking a broader look at emerging market investing, including equity and debt from emerging market and developed market countries, can help investors maximise investment returns on an insight.

Case study: One of the most exciting stories to come from Brazil has been the development of the subsalt fields lying off the Brazilian coast. Some believe that these subsalt fields may contain as much oil as all of Iraq. The obvious way to access this opportunity is by investing in Brazil’s leading oil company. However, this company faces a number of challenges, including technical, financial and political risks.

There are less risky ways to access the opportunity, for example by looking at suppliers to the main exploration companies – the firms that lease out the oil rigs used, or firms that create the steel tubes used in the exploration and production process. Some of these companies only issue bonds; others only issue equity. So a multi-asset approach is able to diversify and manage risk in a way that a single asset class strategy cannot.

Another less obvious investment is in developed market companies that are highly exposed to the emerging markets. Firms like these can help to offset the biases inherent in emerging market equities (which are generally skewed towards a few sectors such as financials, materials, energy and telecommunications services), or provide investment options in the developed market with companies highly leveraged to emerging markets growth.

Lever 3: Emerging market debt universe offers a wide range of instruments and opportunities

The sovereign bond universe is incredibly diverse. At one end of the spectrum, investors can access investment grade bonds from countries like Chile, Mexico and Brazil. These types of securities can be used to lower portfolio volatility. At the other end of the spectrum are sovereign bonds that have remuneration and risks that are more equity-like. For example, Venezuelan bonds are currently yielding 1,150 basis points higher than 10-year US Treasuries.

The option to invest in local currency sovereign bonds provides investors access to currency fluctuation and local attitudes towards inflation, fiscal policy and economic activity. The investor base tends to be local investors, who have very different reasons for holding local currency government bonds compared to their global investor counterparts. Because of this, there are certain local currency bonds that are lowly correlated alternatives.

Emerging market corporate debt is a relatively new, but fast-growing market. These firms range from private companies to quasi-state owned companies, offering investors a broad range of investment options, even if the market has limits to its liquidity.

Inflation-linked bonds protect the underlying security in an inflationary environment. So in a sense, having these bonds in a portfolio will create a real asset. Equities are typically beneficiaries of inflation as a real asset, and fixed income investors can have that protection too. A portfolio manager can have the same investment insight, but have more ways to express that view with lower volatility.

Conclusion

Investors who look at emerging markets differently and who treat it as a single asset class are able to access a broader set of investment options, which take full advantage of the dynamism and growth in the emerging markets, while managing risk. Experienced emerging market investors can create a bottom-up, well-diversified portfolio of equities, bonds and currencies that, over a market cycle, can produce emerging market equity-like returns, with significantly lower volatility.

All data as at 30 November 2013 unless otherwise stated.

This communication is issued by Capital International Limited (authorised and regulated by the UK Financial Conduct Authority). This communication is intended for professional investors only and should not be relied upon by retail investors. While Capital Group uses reasonable efforts to obtain information from sources which it believes to be reliable, Capital Group makes no representation or warranty as to the accuracy, reliability or completeness of the information. This communication is not intended to be comprehensive or to provide investment, tax or other advice.

More Related Content...

|

|

|