Addressing the “blind spots” in emerging market private equity portfolio construction

|

Written By: Nils Rode |

A traditional approach to portfolio construction might create the risk of exposing investors to unseen investment drivers. Nils Rode of Adveq examines two of the most important blind spots

Traditional approaches to the construction of a private equity emerging market allocation focus on diversification by country, strategy, stage, industry, instrument (equity, debt), vintage year and investment type (primaries, secondaries, co-investments). However, while useful, these criteria are not a complete list of dimensions that drive the risk/return profile and diversification of a portfolio.

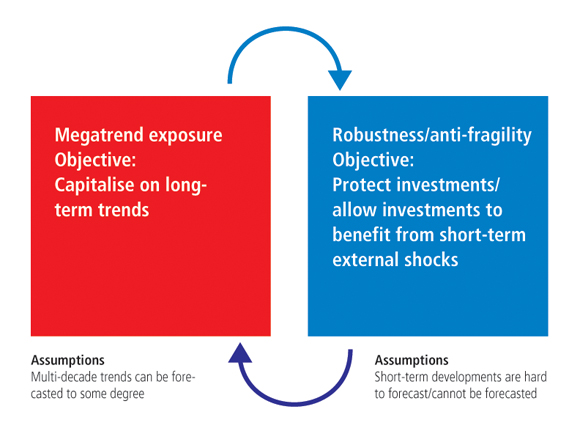

Nils Rode, co-head of investment management at Adveq, the globally active private equity fund manager and adviser, outlines the requirement for a deep understanding of a) the comprehensive megatrend exposure and b) the robustness and “anti-fragility” of a portfolio.

Tailwind from long-term secular trends

Long-term multi-decade trends – also referred to as secular trends or megatrends – can provide long-term tailwind to a portfolio. Given the investment horizon of private equity, the asset class is particularly well suited to benefit from a long-term tailwind.

As long as different megatrends are independent from each other, they can provide additional, long-term diversification benefits to a portfolio. Adveq believes it is important to apply megatrend exposure as an additional dimension for both private equity portfolio construction and the selection of individual private equity investments.

Most investments are exposed to a variety of megatrends to which they can have a positive, negative or neutral exposure. A bottom-up approach assesses existing and potential investments against a combination of relevant megatrends. By following this approach, the total megatrend exposure of a portfolio is determined by aggregating the exposure levels of the individual investments.

Robustness and anti-fragility

For investments to benefit from long-term trends, they need to survive the short term. It can therefore be useful for investors to combine megatrends as an additional dimension for portfolio construction and investment selection with an additional selection filter that focuses on robustness and “anti-fragility”.

Adveq considers investments to be robust when they have a mostly neutral exposure to macro-economic and capital market trends. An example of a robust investment is a company with a demand pattern independent from economic cycles and external financing.

Some investments are not only robust, but “anti-fragile”, meaning that they can even benefit from a macro-economic slow-down or from capital market turbulences. An example of an ‘anti-fragile’ company could be a low-end retailer that is able to substitute higher priced retail channels in times of economic hardship.

Emerging markets at the intersection of five of the seven megatrends

The beauty of investing in megatrends is that they are likely to continue for a long time and therefore tend to be highly predictable. The most important megatrends have been in place for decades, some even for centuries.

Adveq sees seven megatrends that are of particular relevance for long-term oriented investments such as private equity:

- 1. Globalisation

- 2. Urbanisation

- 3. Technological revolution

- 4. Growth of emerging markets

- 5. Environmental challenges and energy and resources scarcity

- 6. Aging of populations in developed countries

- 7. Reversal of the debt cycle in developed countries

Besides the growth of emerging markets – which is a megatrend itself, the other six megatrends also apply to most emerging market investments.

Globalisation benefits emerging markets and creates several opportunities for portfolio companies based in emerging markets. This includes organic growth through export and creation of foreign subsidiaries, external growth through acquisition of foreign companies and efficiency improvements through international sourcing.

Urbanisation is most relevant for emerging markets that are still in the process of catching up with urbanisation levels of the developed world. Portfolio companies in emerging markets can benefit from the growth of products and services that cater to urban consumers, and from growing investments in urban infrastructure and related products and services that have a high urbanisation multiplier.

Technological revolution is a trend that is driven by the exponential increase in computing power at constant cost. Portfolio companies in emerging markets can benefit by being providers of new technology as well as its users sometimes leapfrogging to new business models.

Environmental challenges and energy and resource scarcity are issues that are most pronounced in emerging markets. Portfolio companies in emerging markets can become the providers of new solutions to address these issues, but they can also face significant risks that are related to these challenges.

The other two megatrends that mostly apply for developed countries (aging of populations and reversal of the debt cycle) are relevant for investments in emerging markets as long as these investments have a significant dependence on exports to developed countries.

Figure 1: Megatrend exposure and robustness/”anti-fragility” go hand-in-hand

Robustness and anti-fragility in emerging markets

The robustness and anti-fragility of emerging market countries is very much determined by their dependence on exports to other countries, their dependence on financing from foreign sources as well as their financial strength in terms of government and total debt (compared to GDP), and the size of their foreign exchange reserves. Another factor that is important for international investors is the potential for over or undervaluation of emerging market currencies.

On a portfolio company level, good governance and compliance with ESG criteria is the single most important contributor to robustness of emerging market investments.

Other elements that increase robustness and anti-fragility of a portfolio company are having no or low leverage levels, a focus on products and services for which customers do not require debt financing, revenue generation that is mostly from domestic markets, a strong competitive advantage that provides for pricing power, and no or low dependence on government support and regulation.

Reasonable entry valuations are also very important to ensure the robustness of an investment and to provide it with a suitable “safety buffer”.

Putting it all together: the “ideal” investment in emerging markets

So, when combining all of the above what does an “ideal” investment in emerging markets look like? The following are three examples that illustrate this:

- E-commerce apparel retailer in China: Sourcing from local and other emerging markets and selling to global markets (globalisation), catering to young urban consumers (urbanisation), using internet and smartphones as a sales channel and having the ability to scale up while enabling customer customisation (technological revolution), low to no exposure to adverse megatrends in developed countries (aging, reversal of the debt cycle), well-defined ESG guidelines, moderate entry valuation, financed without debt, focusing on affordable multiproduct consumer segments with substitution potential for higher priced products and delivery channels (anti-fragility).

- Advanced agriculture logistics provider in India: Increased emphasis on being the one-stop agriculture commodity solutions provider for foreign multinationals in their global supply chain (globalisation), better placed at reducing inefficiencies in meeting growing and changing demands of agri products by the urban population (urbanisation), using advanced technology for management and tracking especially in remote locations (technological revolution), low to no exposure to adverse megatrends in developed countries (aging, reversal of the debt cycle), well defined ESG guidelines, moderate entry valuation, low debt levels, operating in a non-cyclical industry sector (robustness), providing financing solutions as a service can witness increasing demand in more difficult macro-economic environments (anti-fragility).

- Electronic payment processor in Africa: Rapid growth driven by regional expansion of the electronic payments business (globalisation), most transactions from large cities (urbanisation), adoption of technology-based payments systems reflecting customer behaviour that is moving away from cash-based payments (technological revolution), low to no exposure to adverse megatrends in developed countries (aging, reversal of the debt cycle), well-defined ESG guidelines, moderate entry valuation, low debt levels, non-cyclical nature of most transactions (robustness), providing card processing services allows banks and retail clients to focus on core operations and reduce costs making such offerings especially attractive in more challenging macro-economic environments (anti-fragility).

Conclusion

When building an emerging market private equity portfolio, the risk/return profile and the long-term diversification of the portfolio can be improved by applying megatrend exposure, and robustness and anti-fragility as additional dimensions for portfolio construction and investment selection. By applying these non-traditional criteria, investors can address potential blind spots in their portfolios. Given the variety of megatrends and robustness/anti-fragility factors that an individual investment can be exposed to, this approach of assessing individual investments and portfolios should be entirely bottom-up. This approach is especially relevant for private equity investments given the long-term nature of the asset class, but it can also be applied to other types of long-term investments in emerging markets and beyond.

More Related Content...

|

|

|