DGFs and sustainability: can multi-asset strategies offer a sustainable solution?

|

Written By: Maria Municchi |

Maria Municchi of M&G outlines the concepts behind building sustainability into a multi-asset strategy

Pension schemes looking to deliver retirement incomes are increasingly giving greater consideration to sustainable investing, with a view to not just fulfil the financial obligations they have to their members, but to do so in a responsible manner. Along with growing numbers of other institutional and private investors, schemes recognise the appeal of approaches that not only target attractive returns, but that also invest sustainably, having consideration for environmental, social and governance (ESG) factors.

Sustainable investing has developed significantly in recent years, building on decades-old principles of ethical investing. Ethical investing usually centres on company or sector-level exclusions and typically focuses on the “moral return” over the financial return. These decisions are often based on an investor’s underlying beliefs. Beyond ethical approaches, sustainable investment strategies take many forms. They may be tightly focused on specific initiatives or target outcomes, while others have a wider perspective for broadly beneficial action. Analysing ESG characteristics has become increasingly commonplace in the last decade with consideration of social and environmental factors in investment decision-making processes.

We believe the ultimate aim of sustainable investing is to influence for better outcomes through our investment decisions. There are a range of tools and processes through which to identify and select assets that can help to target this goal in multi-asset investment solutions such as sustainable DGFs.

Sustainable DGFs: clear objectives, invested responsibly

For the many schemes that use DGFs to target growth and manage volatility throughout market cycles, the opportunity to deliver such outcomes sustainably is an attractive one. Sustainable asset allocation solutions can combine the benefits of flexible and diversified asset allocation with a responsible investment approach.

How does this work in practice? In a multi-asset investment strategy, asset allocation decisions are intended to be the foundations for achieving attractive long-term total returns. A sustainable approach will usually build on these foundations by constructing and dynamically managing the asset allocation from a universe of securities that meet high sustainability standards.

A strong first step in achieving a portfolio with good ESG qualities is to analyse the assets you invest in to ensure the underlying companies adhere to particular qualities or do not undertake particular activities.

One way in which to do that is by implementing what is known as a negative screen. The desired upshot of such a process is sometimes referred to as reducing negative externalities or cutting out the detrimental direct or indirect impacts on other parties of a company’s activities. Exclusions and negative screens can also have the effect of decreasing the availability of funding to companies that are considered to be negative influences.

By the same token, a positive screen can help support organisations recognised to be doing good, or better than others, in a particular field. It can reward those good performers and is a complementary ESG analysis technique that aims at increasing positive externalities; capturing intended or unintended positive influences.

Overall the goal is to identify those companies operating more sustainably and those more capable of adapting to a changing world where incorporating ESG behaviours is standard procedure. Both approaches can have a part to play in a successful sustainable allocation process.

Integrating ESG considerations into investment decisions that are ultimately driven by fundamental analysis and assessments of value is another step along the spectrum of sustainable investing. ESG analysis scrutinises the material extra-financial factors that may present risks and opportunities for companies and public entities, helping to inform our investment decisions and their suitability for inclusion in portfolios.

Undertaking active engagement takes that a stage further, working with companies to try to encourage responsible behaviour and improvements in their processes, so they can deliver positive outcomes.

Negative screens, positive screens, ESG analysis and engagement are all parts of a comprehensive approach to asset selection and portfolio construction.

Focusing on positive impact

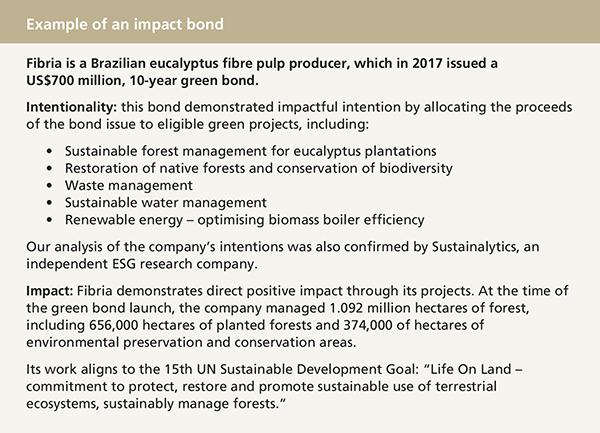

Sustainable investing continues to develop as investors establish new methods and techniques to foster good outcomes and positive change. Impact investing is an example of this, and focuses on companies or funds that proactively deliver or target a positive environmental or societal impact.

M&G has invested for impact in private and illiquid assets for some years but now also undertakes impact investing in listed instruments. By investing via listed equities, impact investment becomes available in a liquid form more easily accessible for smaller scale pension schemes as well as individual investors, whereas formerly it was frequently the preserve of larger portfolios.

By identifying individual assets, be they shares in or bonds issued by individual companies or supranational agencies, that demonstrate that they actively make a positive contribution, it is possible to build a portfolio that truly demonstrates responsible investing. An approach such as this aims to give investors the opportunity of seeking attractive financial returns while actively contributing to a more sustainable society.

For Investment Professionals only. Not for onward distribution.

This article reflects M&G’s present opinions of current market conditions. They are subject to change without notice and involve a number of assumptions which may not prove valid. Past performance is not a guide to future performance. The distribution of this article does not constitute an offer or solicitation and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. Information given in this article has been obtained from sources believed to be reliable although M&G does not accept liability for the accuracy of the contents.

The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at 10 Fenchurch Avenue, London EC3M 5AG. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|