The time is now: how equity hedging strategies can efficiently protect portfolios

|

Written By: Regis Lelong |

|

Rohan Tawadey |

As investors and asset allocators increasingly consider the probability of a more volatile outlook for financial markets, Regis Lelong and Rohan Tawadey of Citi reveal how equity systematic solutions can efficiently and effectively hedge equity portfolios

Over the past decade equity markets have driven portfolio performance, benefitting from price appreciation and dividends. Transparent and liquid, and supported by an increasingly efficient market structure, investors have gained exposure to domestic and international equities via stocks and indices.

As equity markets reach new highs, investors question if we are entering the late stage of the economic cycle. Simultaneously, investors do not wish to prematurely exit markets and are compelled to seek potential returns given persistent low yields.

Within this context we consider equity hedging strategies. Whilst there are many potential solutions that use derivatives, we highlight systematic option overlays to support a smoother risk-returns profile and efficiently manage implementation and market risks.

Market risks and implementation matter

In a late cycle environment, investors increasingly look to reduce the potential for losses from equity exposures by investing in uncorrelated public and private market assets. Recent history has shown that during periods of rising market volatility, supposedly diversifying investments are not truly uncorrelated. Further, there are limited opportunities to access private markets, and investors may consider concentration and illiquidity risks to be high in these private markets. In contrast, publicly traded equity remains more liquid and conducive to building a portfolio of stocks or indices even during times of market stress.

Investors seem unprepared to forgo potential equity upside by unwinding their positions too soon, and increases in market volatility would imply the potential for larger day-to-day price fluctuations. This means that investors are exposed risk of both the “what” and the “how” of risk management.

Hedging objectives

Investors consider three key questions:

- Should I hedge?

- What should I hedge?

- How should I hedge?

Regarding the first question – current historic highs in equities and late-cycle dynamics imply that holding equities without any hedging or protection is increasingly risky. To mitigate risks and reduce uncertainty of returns, a hedging strategy could reduce volatility and the potential for drawdowns at a low or potentially zero cost.

Considering the second question – what should I hedge? – there are various approaches towards hedging. The optimal approach will reflect the investor’s goals and sensitivities, balancing these against costs, both in terms of a premium paid and also the opportunity cost of any potential returns that are forgone, where relevant.

There are various risks to hedge. Asset owners are concerned around tail risk events: price movements outside an anticipated or normal range. A catalyst for such a move would be a significant or perhaps unforeseen event, sometimes called a “black swan”.

Event risk hedging considers the possibility that an unforeseen outcome of an event will negatively impact financial markets. It also includes environments in which high volatility leads to substantial swings in asset prices.

Capital preservation, reducing portfolio volatility, and funding ratio hedging are additional objectives.

Implementing a hedging strategy

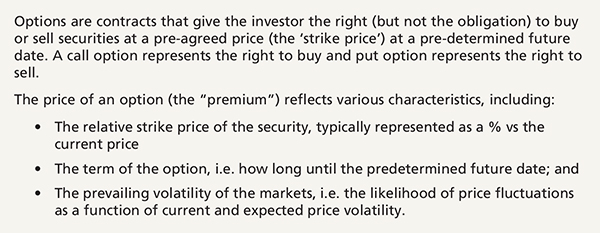

Now – how should I hedge? Options and option strategies are used by asset allocators to better prepare for market downturns and rising volatility. Options can mitigate either broad portfolio risks, or specific exposures within a portfolio. They are widely used by a range of investors for both investment and risk management purposes. The most liquid equity options are written over equity indices. These options are often quoted on listed exchanges. Banks as primary market participants have the unique capacity to deliver efficient options strategies.

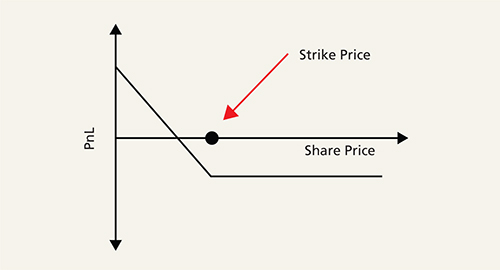

One of the most common solutions to protect an equity portfolio is to use equity options – i.e. purchase a put option. For the premium paid, investors would gain if the price of the underlying market were to decline (Figure 1).

Call overwriting is another popular strategy which combines the objective of yield enhancement – with some defensive properties during periods of falling equity markets.

Figure 1: Investor’s exposure to purchased put option

Source: Citi. For illustration only.

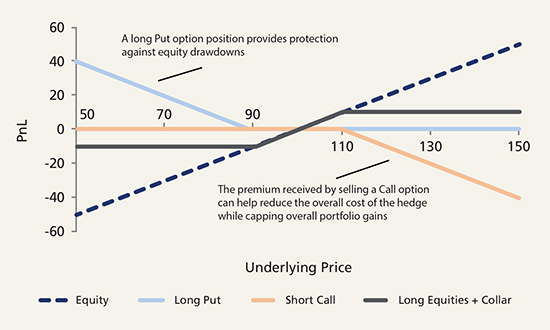

Combinations of options can also create cost effective approaches towards defensive portfolio positioning. For example, to finance the premium of the put option for hedging, an investor can sell a call option. The call seller collects a premium and forgoes some of the participation in market growth. Selling call options can generate income as well as act as a cushion in case of downside. When the market rises the seller needs to pay the difference between the underlying and the pre-agreed price. A particularly interesting feature of call selling is that the premium collected usually increases in periods of higher market volatility, which could make the proposition even more compelling.

The combination of buying a put option and selling a call option on the same underlying with offsetting premia is called a zero-cost collar. Figure 2 illustrates how the investor’s exposure to significant losses (and gains) is curbed.

Figure 2: Zero-cost collar strategy?

Source: Citi. For illustration only.

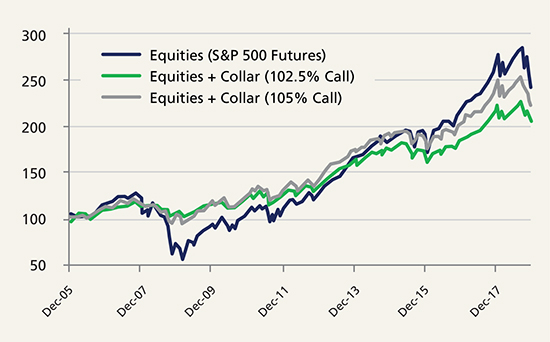

Figure 3: Impact of hedging strategy on S&P500 returns

Source: Citi. For illustration only. Past performance is not indicative of future results.

Figure 3 illustrates the impact of a systematic hedging strategy on exposure to the total performance of the S&P 500® Index. The ‘Futures’ plot shows the unhedged exposure. The hedged exposures are shown for a generic equity collar strategy with 90% put and 102.5% or 105% call strikes. For the period shown, the hedged exposures did not suffer from the sharp drawdown but some of the positive performance was forgone. The time to recovery of a hedged index is usually shorter and volatility is lower.

A systematic approach

Once the implementation decision has been made, the next consideration is how to efficiently maintain the defensive position. There is no-one-size-fits-all approach, and the strategy will ultimately reflect the risk profile of the hedger after an iterative design process with a solution provider.

Efficient implementation is not only about keeping costs low, but crucially ensuring that the strategy performs as expected. Recently rules-based approaches towards implementation have been developed, which balance efficiency, transparency and costs.

These strategies typically seek to diversify payoff and execution risks by purchasing a smaller number of options more frequently. In addition to these advantages, a systematic approach reduces behavioural bias. Investors typically decide to hedge only after markets have become more volatile and at that point face higher costs of protection.

Example: 12 month put purchase

In periods of steady market growth, the protection level of a put option will move further away from the current value of the portfolio. For example, a put option originally targeting 90% portfolio protection may glide towards a protection level that is 85% or even lower. This means that the option may become less effective in protecting mark-to-market downside risk versus the originally intended level, and that investors have paid a higher premium for relatively less protection.

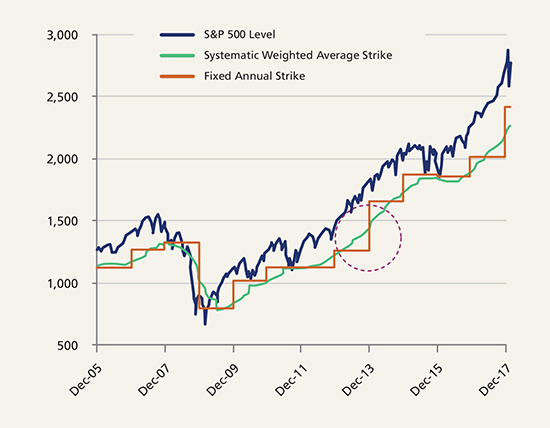

Buying options with equally distributed expiries can provide an enhanced outcome. As a result of daily execution, the weighted average strike level of the option portfolio tends to track the market performance more accurately. Figure 4 illustrates a systematic 12 month rolling put strategy with a 90% target strike on the S&P 500® Index, and which effectively “closes the gap” vs a fixed annual strike approach.

Figure 4: Rolling put option

Source: Citi. For illustration only. Past performance is not indicative of future results.

Example: diversification of strikes and associated payouts

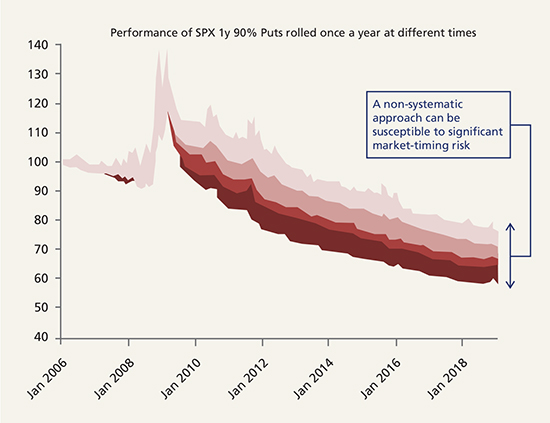

Single options are sensitive to their specific entry points. Figure 5 demonstrates the major impact of market-timing risks of a put option rolled once a year on a different day. A systematic implementation is equivalent to purchasing protection on a daily basis for a smaller proportion of the portfolio. This averages payouts over many options and entry dates which lead to greater diversification and a smoother payout profile over the same market performance window.

Figure 5: A non-systematic approach can be susceptible to timing risks

Source: Citi. For illustration only. Past performance is not indicative of future results.

A similar concept applies to the implied volatility regime. Implied volatility is a major driver of option prices, and can vary significantly over time. By spreading purchases over time, the sensitivity towards sharp changes in volatility, and the associated premiums paid/received, is reduced.

Additional considerations

A systematic options strategy can deliver an efficient and effective way to hedge a portfolio, with reduced behavioural risk and a smoother application that is more targeted. It is important that the strategy performs as expected and dynamically evolves to changing market conditions.

Portfolio managers should also be aware of the counterparty to the option, as well as pricing transparency and mark-to-market monitoring. The performance, protection level and option composition should be frequently communicated to decision-makers. Mechanisms to support exiting or changing (up- or down-sizing the strategy) the strategy should be defined upfront and within the objectives.

Marketing material for professional investors and advisers only. The material is provided by individual sales and/or trading personnel of Citi and not by Citi’s research department.

More Related Content...

|

|

|