Easing the constraints

|

Written By: John Dewey |

|

Stuart Jarvis |

John Dewey and Stuart Jarvis of BlackRock discuss flexible fixed income investing in a portfolio context

Turbulent conditions continue to make for a highly challenging environment for fixed income investors. As the end of ultra-loose monetary policy approaches in the US and UK, bond market participants are seeking ways to avoid potential losses that a rise in interest rates could inflict on their portfolios. And while the search for potential solutions intensifies, one thing is becoming clear: sticking to old-fashioned, tried-and-trusted approaches will no longer work.

The reason for examining traditional fixed income portfolios now is clear enough: for years, traditional core bond strategies have tended to track or exceed a market index, such as an “all-stocks” or aggregate bonds index. Investing in this way worked well during the 30-year bull market in interest rates, providing income, diversification and positive total returns. But last year bond indices performed less strongly, as the All Stocks Gilt Index delivered a return of -3.9%. after posting an average annual return of 5.3% between 1998 and 2014.

The catalyst for last year’s losses was the US Federal Reserve’s first hints that it planned to begin tapering off its support for the bond market. While the US presses ahead with an end to quantitative easing, however, much of the rest of the developed world looks set to remain in a monetary easing mode for some time to come. The result will be a divergence in fixed income performance by region and asset class.

Add to this the fact that policy and rate changes will differ markedly by country, and the capital allocation implications of the current environment become clear. Simply put, it means that fixed income investors will need to exercise opportunism and flexibility as markets adjust rapidly to changes in economic prospects, monetary policy and secular dynamics that promise to play out differently in various parts of the world.

What can investors do to improve the risk/return profile of their bond portfolio?

Benchmark-constrained global bond strategies are facing steep challenges in today’s low interest rate environment. Low yields provide little cushion against negative total returns and limit the potential to achieve the attractive absolute returns witnessed over recent years. They also mean that more risk is required in order to generate a specific yield level.

Investors seeking total return with lower volatility may consider reallocating a meaningful portion of their traditional benchmark-oriented portfolio to a diversified fixed income strategy that allocates very broadly across sectors and geographies. An active approach that rotates portfolio allocations across sectors, if successfully implemented, can enhance returns, increase diversification and minimise volatility.

Increasing numbers of investors are seeking return premia from a variety of sources to generate positive returns in all market environments. Where bonds are used by investors to generate returns (rather than to meet specific liabilities, as undertaken by many pension funds and insurers), the end of the secular decline in bond yields demands new techniques. Just as many investors diversified from equities, some are now beginning to diversify away from traditional benchmarks and management styles to a wider spectrum of fixed income markets.

Clearly, any adoption of a more flexible approach to fixed income will depend upon the investor’s individual objectives and circumstances. Reading on, we consider various approaches that might be taken by local authority investors.

Flexible fixed income investing for local authority investors

Local authority investors adopt a range of approaches to fixed income investing, with allocation sizes varying accordingly. Increasingly, a liability-focused approach encourages a greater allocation to high quality fixed income assets for matching purposes. Here, we focus on the other primary use of fixed income assets by local authority investors – providing diversification in a long-term portfolio and income to meet liability and other cash needs.

Diversification

For such investors, assessing the risk/reward trade-off of owning fixed income on a standalone basis will probably hold less weight than understanding the asset class’s diversification benefits across the portfolio. Historically, government bonds have typically been negatively correlated to equities. Equities typically underperform during recessionary/deflationary and flight-to-quality events, and government bonds have traditionally been used to help cushion diversified investors against periods of significant equity drawdowns.

The diversification properties of high quality government bonds are not stable, however, as seen in 2013 when the correlation with equities sharply turned positive. Using a wider range of return drivers, as well as active management, reduces the reliance on correlations to protect investors from extreme events.

Reward for interest rate risk

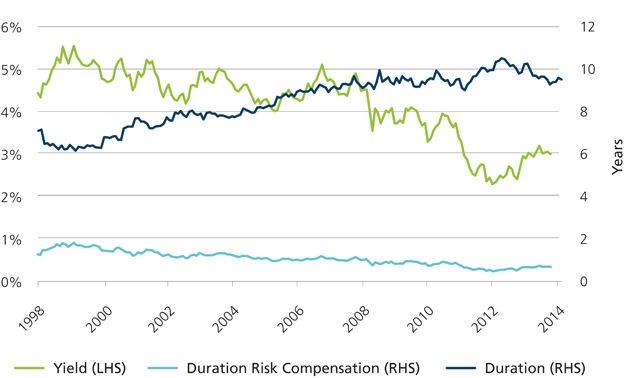

In recent years, though, the reward that investors can expect for tracking government bond returns has fallen significantly below its long-term average level. Figure 1 plots the ratio of the UK conventional gilts All Stocks index yield to the index duration (the “duration compensation”). In 1998, the compensation was close to 1% of yield per year of duration. By April 2014, the duration compensation had drifted to down to 0.3% and was close to historic lows.

Figure 1: Historical duration compensation of All Stocks government bonds

Source: BlackRock, Datastream

Since 1998, the long-term average duration compensation has been around 0.5% of yield per year of duration risk. The yield on today’s All Stock index is around 3%. Historically, this would be sufficient to compensate an investor for bearing 5.8 years of duration exposure, compared to the current duration of 9.6 years.

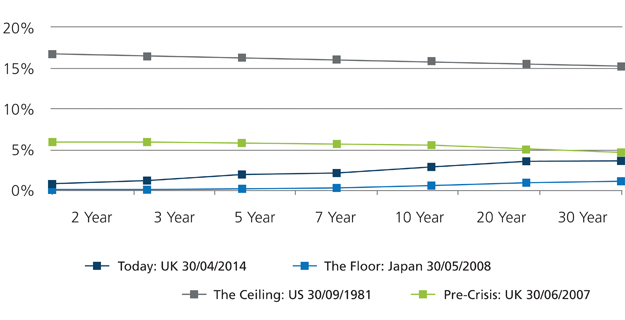

The reduction in risk compensation has significantly reduced the value of the flight-to-quality insurance provided by government bonds. To understand this better, let’s take Japan’s yield curve from May 2003 as a yield curve floor, and the US yield curve from September 1981 as a ceiling. We take these yield curve bounds to represent the maximum “tail risk” upside and downside for a government bond investor and compare with the current and pre credit crisis UK Government Bond yield curves. Figure 2 displays all four curves. If the UK has a deflationary scare on a par with Japan in 2003, the upside for government bond investors may be approximately 26%. Conversely, if the UK has a stagflation scare that ultimately leads to an interest rate environment on a par with that of 1981, the downside for the same government bond investor would be around -70%. Finally, and as a more likely base case, if the UK drifts back to an interest rate environment comparable to June 2007, the government bond investor may face a downside of approximately -23%.

Figure 2: UK Government bond yield curve placed in a hypothetical global rate context (%)

Source: Barclays POINT, BlackRock

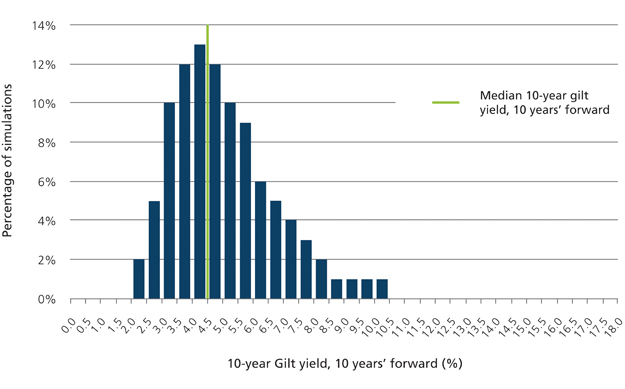

This asymmetry is further illustrated by stochastic projections of future Gilt yields in Figure 3 (opposite). The distribution is “positively skewed” indicating a much wider range of possible outcomes at higher yields than at lower yields.

Figure 3: Distribution of outcomes for 10-year gilt yields in 10 years’ time

Source: BlackRock, Moody’s Analytics

Drivers of returns

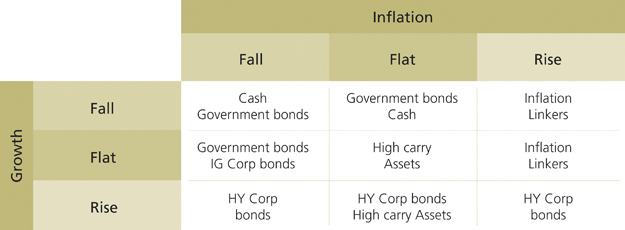

Inflation and economic growth are two of the main macroeconomic drivers of asset returns. In Figure 4 (opposite) we map out the fixed income assets we expect to outperform under specific scenarios of growth and inflation. The table shows that holding a broad range of assets in a passive portfolio may be necessary in order to provide stability over a variety of economic backdrops.

Fixed income assets can be thought of as belonging to two categories: one including deflation hedge investments (cash, government bonds, investment grade corporate bonds, mortgage-backed securities), and another including pro-growth investments (high yield corporate bonds, high carry assets and inflation-linked bonds). The argument for holding a diversified portfolio of assets from both groups is reinforced by the historically negative correlation between government bond returns and equity returns, as discussed earlier.

In an environment of considerable uncertainty in the growth and inflation outlook, successful active management positions the diversified fixed income portfolio to pre-empt and exploit future changes in the growth and inflation environment.

Figure 4: Macroeconomic map of fixed income assets (covering inflation and growth)

Source: BlackRock

A tool for the times

The bond market continues to undergo profound changes, and investors should not underestimate the challenges they pose. A flexible fixed income strategy is, of course, not a panacea. Despite the resources needed to make it work, it is something much simpler: a tool for the times. As the market moves of last year made clear, bond portfolios designed to generate long-term performance and tethered to a conventional benchmark are ill-suited to a climate of rising rates, scarce supply, and periodic volatility. In times like these – and in times to come – adaptability is likely to be an advantage.

Changing investment approaches that have worked well for a generation is not something to be done lightly. But when the conditions that made those approaches so successful cease to exist, the imperative is clear. During a transitional time in the global capital markets, allocating a portion of the fixed income portfolio to a flexible strategy can provide important risk management benefits, as well as access to new sources of return.

More Related Content...

|

|

|