Emerging markets: a promising year ahead?

|

Written By: Scott Berg |

|

Mike Conelius |

|

Andy Keirle |

Following an eventful 2013 for emerging market investors, T. Rowe Price portfolio managers look ahead to 2014 at the prospects for both EM equity and fixed income markets

After volatile summer months when investors fretted about the US Federal Reserve’s plans for tapering asset purchases, global capital markets ended 2013 on a relatively positive note and emerging economies showed signs of stabilising.

Emerging market equities: contrarians step forward

Conventional market wisdom has largely settled on a bearish outlook for EM equities in 2014. Set against a backdrop of slower economic growth, inflationary wage pressures and relatively high interest rates, investors fear that earnings momentum will be hard to come by.

The earnings disappointment story is not without foundation, but forward-looking concerns are exaggerated. While the short-term outlook has been challenging in the aggregate, the relative earnings power of EM companies over the past five years, still looks favourable compared to most of the developed world.

What’s more, the long-term secular case for superior EM earnings growth remains firmly intact, making current depressed valuations look more attractive from a contrarian point of view.

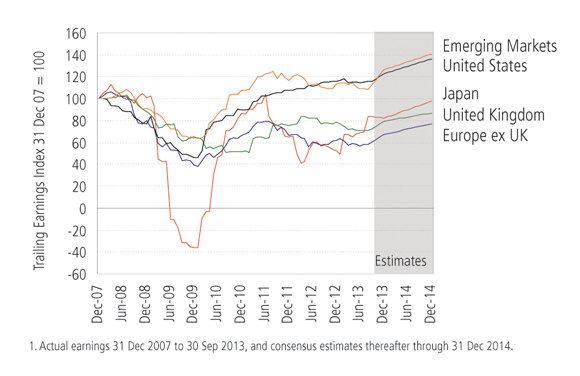

A look at earnings per share (EPS) in some of the world’s major markets illustrates the point. Across most of the world, earnings are still below – and in the case of Europe, well below – their pre-financial crisis peaks. There are two notable exceptions: the United States and the emerging world (Figure 1).

Figure 1: 12-month earnings per share growth since 31 December 20071

Sources: Goldman Sachs, FactSet, Citi Research, MSCI. Source for MSCI data: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI.

These results are also broadly reflective of the forward-looking expectations we hear from major multinationals companies: they are still relatively excited about business opportunities in the US and EM, but relatively cautious regarding Europe and Japan.

US and EM earnings trends have diverged over the past two years. Taking the emerging world in aggregate (although such a simplistic view is not dissimilar to considering Japan, Europe and the US together), EPS has been flat to modestly down, while the US has continued to show a steady upward sloping trend line. Not surprisingly, markets typically reward steady and sure patterns with a valuation premium.

However, the economies that constitute the emerging world are very diverse, and it’s problematic to paint them all with one brush. As of 30 September 2013, EPS was 24% below the 2007 peak in Latin America, but up an average 41% in emerging Europe and the Middle East, and up more than 60% in emerging Asia.

Given the nature of EM benchmarks, it’s no surprise that in the lagging markets much of the decline has been concentrated in a relatively small number of stocks, many of them in the energy and metals and mining industries.

In relation to the weakness of commodity-oriented sectors, we agree that the commodity boom that has driven some emerging economies over the past decade is probably over and the drivers of EM profitability and return are evolving. There are many EMs that are reversely leveraged to commodity prices. Cheaper materials, particularly oil, will benefit consumers and ultimately ease pressures from inflation and current account deficits.

Given our view that consumer demand is the key to sustainable EM growth going forward, we maintain a view that many EM companies are set to deliver positive earnings surprises versus beaten down expectations. There is room for a catch up in EM earnings growth that potentially could match or exceed the US market over the next three years. Given valuations in the emerging world have stagnated during a time when developed world valuations have experienced a significant re-rating, we see attractive upside for EM stocks, both on an absolute and relative basis.

Despite poor over-hanging sentiment, the balance of risks for investors in 2014 is skewed towards waiting too long before believing in a re-rating of EM equities, rather than a reallocation towards the EM world today being too early.

EM debt: cheaper, not weaker

The past year has been difficult for emerging debt markets. Concerns about US monetary policy, along with commodity price declines and slowing growth in many emerging economies, led to significant capital outflows and a sharp rise in yields. Some analysts have even compared the situation to the Asian debt crisis of the 1990s.

We believe such comparisons fall very wide of the mark. If anything, the events of 2013 demonstrated the enormous – and largely positive – changes in the EM debt universe over the past decade and a half:

- Fiscal reform: Sovereign balance sheets are generally healthy, with low public debt ratios and – with some exceptions – low budget deficits.

- Monetary policy: As a group, EM central banks have demonstrated the credibility of their commitment to long-term price stability. Foreign exchange reserves are at or near record highs, while floating exchange rates provide a critical circuit breaker against systemic shocks.

- Banking regulations: Prudential measures have improved EM banks’ balance sheets and limited currency mismatches on assets and liabilities. Corporations have also become more financially conservative.

More to the point, comparisons to the 1990s ignore the dynamic evolution of the EM debt market since that time, such as the growth of the EM local currency and EM corporate markets – both of which provide opportunities for diversification that didn’t exist 15 years ago.

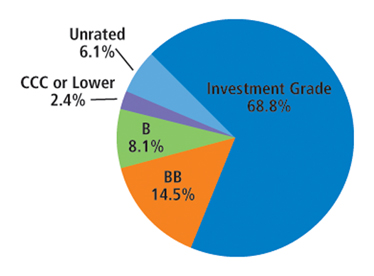

While still not as liquid or transparent as developed world bond markets, these new asset classes are larger and of higher quality than many investors may realise. The EM corporate market, for example, already has a larger market capitalisation than the US high yield market, and is almost 70% investment grade (Figure 2).

Figure 2: Credit quality of the corporate emerging market bond broad diversified index, as of 30 Sept 2013

Source: J.P. Morgan

The importance of these changes can be measured by what hasn’t happened in EM debt markets since the US Federal Reserve started to talk about tapering its asset purchases. EM banks have not failed, corporate defaults have not soared, and emerging currencies have corrected, not plummeted. Indeed, the transition from fixed to floating exchange rate regimes is perhaps the singular reform that has reduced EM systemic risks.

Valuation shifts have reflected the same measured pattern. Yields and spreads have risen, returning to near their five-year averages. In our view, this gives investors a new opportunity to establish or add to under-sized allocations. Particularly in the current fixed income environment, EM debt appears to offer strong relative value versus comparable sectors in the developed markets.

“Tapering” headwinds remain, of course. A world of more discriminating capital flows is likely to encourage and reward incremental reforms, but punish the laggards. That being the case, we would regard any further market disruptions in 2014 as potentially attractive buying opportunities. However, fundamental analysis and differentiation will be critical.

This article is provided for information purposes only and is not intended to reflect a current or past recommendation, investment advice of any kind, or a solicitation of an offer to buy or sell any securities, T. Rowe Price products or investment services. Past performance cannot guarantee future results. Information contained herein is based upon sources we consider to be reliable; we do not however guarantee its accuracy. This article provides opinions and commentary that do not take into account the investment objectives or financial situation of any particular investors or class of investor. Investors will need to consider their own circumstances before making an investment decision. The views contained herein are as of December 2013 and may have changed since that time.

T. Rowe Price International Ltd (“TRPIL”), 60 Queen Victoria Street, London EC4N 4TZ is authorised and regulated by the Financial Conduct Authority.

T. ROWE PRICE, INVEST WITH CONFIDENCE, and the BigHorn Sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc. in the United States, European Union, and other countries.

More Related Content...

|

|

|