Emerging markets corporate bonds: an asset class comes of age

|

Written By: Urban Larson |

Urban Larson of Standish Mellon examines the growing opportunities in emerging markets for corporate bond investors

The allure of emerging markets for investors, with their high growth and increasing bond opportunities, remains substantial. This despite the sell-off in 2013, increased volatility in some markets, worry over China and the perception of increased political risk in the wake of Ukraine/Russia tensions.

Over the five years to 31 July 2014 there has been more than US$380 billion in inflows across the 10 main Lipper global emerging market fund sectors, which include both fixed income and equity funds. By June 2014 funds across the 10 sectors had accumulated more than US$2 trillion in assets.1

Returns have had no small part in attracting such inflows. The MSCI Emerging Markets Equity index has returned 218.91% over the past decade to 31 July 2014 compared to 114.85% from the S&P 500, both in US dollar terms. Even in the more difficult recent past, emerging market equities have fared reasonably well, up 45.45% in dollar terms over the five years to the end of July.2

Government bonds across emerging markets have also had positive returns over the longer term. The JP Morgan GBI-EM Global Diversified index has gained 35.29% in US dollar terms over the past five years and 3.39% over the past year. While the latter may appear to be a small gain, by comparison the Bloomberg US Treasury index shows a return of 2.34% in local currency terms over the past 12 months.3

Growth in emerging markets corporate bonds

As emerging market debt (EMD) has become an increasingly mature, investment-grade asset class, a growing number of emerging market (EM) corporations have followed the lead of EM governments in issuing bonds to both local and international investors. This has greatly widened the range of opportunities that are available to investors in EMD even as the asset class as a whole has continued to grow. With the higher quality EM sovereigns now trading at very tight spreads, EM corporate bonds have become an attractive alternative. The investable universe of EMD at the end of the first quarter 2014 comprised more than US$2 trillion in bonds4 while sales by EM corporates and sovereigns reached US$69.47 billion in the first half of this year, a 54% increase on the first six months of 2013.5

Emerging markets US dollar-denominated sovereign debt has become a well-established, mainstream, asset class over the last 20 years while most of the large emerging markets countries have earned investment-grade ratings. This has paved the way for emerging markets corporations to follow the lead of their developed-country peers and issue bonds in the international markets. EM corporate debt in US dollars is now a well-established asset class and offers a reasonable alternative to investors in emerging markets who are comfortable taking on corporate credit risk. This corporate debt alternative has become especially attractive of late, given that significant crossover investment in the sovereign bonds of the bigger, higher quality emerging markets has led to these bonds trading at very tight spreads.

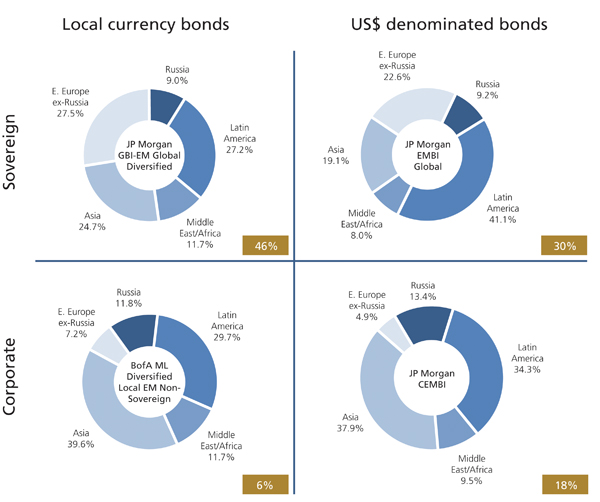

Figure 1: Investable universe of emerging markets

Source: Standish, JP Morgan, Bank of America Merrill Lynch. As 30.06.14

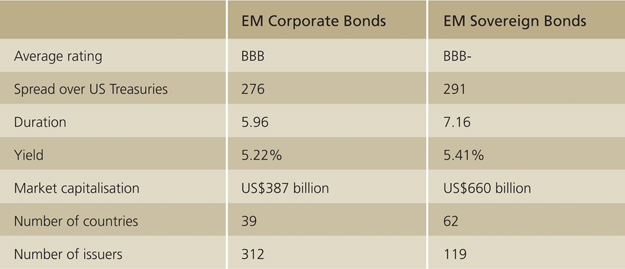

In general, EM corporations that issue bonds tend to be the larger, more sophisticated companies from the higher-rated EM countries. Many of these companies are exporters, and most can boast of high-quality balance sheets: the average credit quality of the JP Morgan CEMBI Diversified index, the main benchmark for EM corporate bonds, is BBB, one notch higher than the rating of the JP Morgan EMBI Global index, the equivalent benchmark for EM sovereigns. EM corporate debt is also shorter duration (which helped it to outperform EM sovereign debt in the mid-2013 market sell-off). Yields and spreads for EM corporate bonds are only slightly lower than they are for EM sovereigns.

In several big EM countries that have well-developed and liquid local currency government bond markets such as Mexico, Brazil and Russia, corporations are issuing local currency bonds as well. This newest asset class is still relatively small but it is growing. The fact that JP Morgan has not yet created an index for it (although in 2013 Bank of America Merrill Lynch launched an index) underlines that local currency corporate bonds are still primarily of interest to local investors. This may change as the asset class continues to grow.

Now that the leading EM countries are able to fund themselves with ease in their own currencies, they are issuing fewer US dollar bonds. Most of what these countries do issue in US dollars is not to raise new funds, but simply to improve the profile of their existing debt by lengthening the maturities or reducing the yields, or to pay off bonds that are maturing. The growth of the asset class is being driven largely by new entrants: smaller, lower-quality EM countries that have little experience of bond issuance on purely commercial terms.

Figure 2: Emerging market bonds

Source: Standish, JP Morgan, as of 31.7.14

As a result, US dollar bond issuance in the emerging markets has become increasingly dominated by EM corporates. 2014 is on track to be a record year for EM corporate bond issuance: $130 billion was issued in the first seven months of the year, compared to $195 billion for all of 2013.

The overwhelming majority of corporate issuance (72% in 2014) has been of investment grade securities. Initially issuance was dominated by Latin American corporates with their ability to generate US dollars from commodity exports and close ties to the US market. Since 2012 Asian corporates have been the biggest issuers, accounting for just under half of total issuance.

In the current buoyant bond market it has been easy for companies to place bonds with both dedicated EM and crossover investors participating in issues. The CEMBI Diversified index has continued to do well despite the heavy supply, rising 7.0% (Source: Bloomberg, JP Morgan) in the first seven months of this year.

EM corporate bonds are of interest not just to pure EM or global corporate bond strategies, but also to blended or opportunistic strategies that invest in the full range of EM bonds, including local currency corporate bonds. US dollar denominated strategies traditionally have invested only in sovereign and quasi-sovereign bonds. Nonetheless these strategies are faced with an asset class in which the issuers with the best fundamentals are trading at very tight spreads while new issuance is often coming from lower quality issuers. EM corporate bonds from those countries with good fundamentals can be a way to increase the yield of a portfolio without adding too much risk. This growing asset class is clearly well on the way to become a mainstream investment.

1. EPR

2. Bloomberg as at 8 August 2014

3. Bloomberg as at 8 August 2014

4. JPMorgan, Bank of America Merrill Lynch, Standish as of March 31, 2014

5. Concerns over debt market euphoria. FT. 21.07.14

Important Information

Past performance is not a guide to future performance.

The value of investments and the income from them is not guaranteed and can fall as well as rise due to stock market and currency movements. When you sell your investment you may get back less than you originally invested

This is a financial promotion for Professional Clients only. This is not intended as investment advice.

Any views and opinions expressed hereafter are those of the investment manager, unless otherwise noted. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. This document is issued in The UK by BNY Mellon Investment Management EMEA (BNYMIM EMEA), BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority.

BNYMIM EMEA, Standish Mellon Asset Management Company LLC (“Standish”) and any other BNY Mellon entity mentioned are all ultimately owned by The Bank of New York Mellon Corporation Issued 15/9/2014 CP13536 15-12-2014 (3M)

More Related Content...

|

|

|