Investing in credit to meet short- and long-term cash flows

|

Written By: Paul Richmond |

Forced to consider the possibility of future negative cash flows, pension funds may find what they are looking for in secured finance. Paul Richmond of Insight Investment tells us more

As local authority pension funds mature, they are faced with the challenge of managing the possibility of negative cash flows, when payments to retirees exceed contributions and income from investments. This comes after many have been faced with additional headwinds, including rising liability valuations, which have led to higher contributions required from authorities and other participating bodies.

Every pension fund aims to cover both short-term liability payments and meet long-term commitments. If a fund receives more in contributions and investment income than it pays out, it can pay benefits as they fall due and continue to invest assets for long-term growth. However, if a pension fund is cash flow neutral or negative, it might be forced to sell some of its assets to fulfil its obligations, and potentially before those assets generate the returns expected of them over the longer term.

A pension fund that plans ahead and preserves its allocation to long-term return-seeking investments, giving them time to perform, can be more certain of meeting its ongoing liabilities without adversely affecting its ability to achieve long-term targets.

Pension funds and their advisers have been reviewing their likely cash flow requirements and considering how to prepare for the time when their net cash flow turns negative. Dealing with this means answering two questions: how to structure a pension fund’s overall investments, and which asset classes might support its goals.

We believe there are interesting investment opportunities which can combine the potential for strong returns with a high probability of providing cash flows within specified timeframes. These opportunities could play a role in helping local authority pension funds tackle their challenges.

The role of focused credit investment

One approach taken by some pension funds is to focus on selective investments in corporate bonds. By buying the bonds of companies on which you have formed a fundamentally long-term positive view, and then keeping those bonds until maturity, you can build a portfolio that is tailored to meet your specific needs in terms of amount of income and timing of income, with holdings that reflect when pension payments are due.

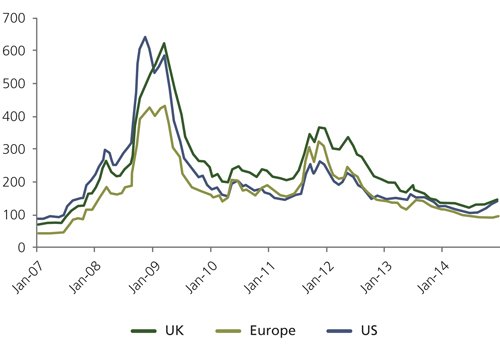

Figure 1: Investment grade corporate bond yield spread over government bonds

Source: Merrill Lynch, 31 December 2014.

However, the compensation available for investment grade corporate bond investors today is materially lower than it has been in recent years (see Figure 1). Also, if bond yields were to rise more than is already priced in by the market, the capital element of such fixed interest investments will fall in value.

Investors looking to maintain attractive returns are faced with a difficult choice. They can reduce credit quality, they can raise leverage, or they can explore more niche strategies where they may be paid higher yields for accepting increased complexity or lower liquidity.

Secured finance: a potential source of higher yields and solid credit quality

Investing in secured finance could offer a compelling opportunity for investors who seek to generate excess returns while preserving credit quality and remaining unlevered. Its characteristics mean it can play an important role in the investment strategies of pension funds facing the challenge of negative overall cash flows.

Secured finance assets are credit investments that are secured against other assets. They include investments in residential mortgages, commercial real estate or corporate loans, and supply chain finance (see “Examples of secured finance investments” below). With the balance sheets of European banks equal to four times Eurozone GDP, banks continue to face pressure to scale back their lending activities. This is creating a structural investment opportunity for non-bank lenders such as pension funds and other long-term investors to step in to provide much-needed finance.

Because these investments are secured against collateral, the ratio of return to expected default probability is materially higher than that of traditional corporate bonds. Secured finance investments are also typically floating rate in nature: this should protect investors as income would increase with rising interest rates.

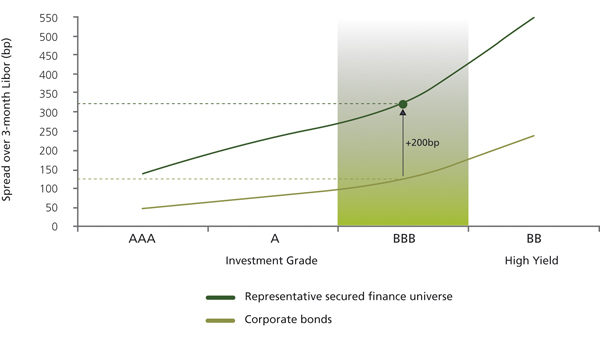

Figure 2: Better risk/reward from investment grade secured finance versus comparable bonds

Source: Insight as at 31 December 2014. The spreads shown are for illustrative purposes only.

Secured finance assets could offer yields substantially above investment grade corporate bonds with equivalent credit ratings (see Figure 2). This excess yield is partly due to the complexity of the underlying assets which are harder to research. Analysing risk and opportunity in secured finance requires expertise to understand and assess many aspects of each specific asset, including the seniority of credit risk and the associated legal documentation, the nature of any credit enhancements, as well as liquidity and mark-to-market risks.

In today’s environment, secured finance assets could offer a much better risk/return package than equivalent-rated corporate bonds, though the latter are typically more liquid, easier to access and simpler to analyse. By carefully selecting assets with fixed maturities, attractive yields and credit ratings, such mandates should be able to help local authority pension funds invest other assets in areas with the potential for longer-term growth, while offsetting the risk that negative cash flows might interfere with long-term goals.

Examples of secured finance investments

Asset-backed securities (ABS): Bonds or notes secured against a pool of assets, such as car loans or credit card receivables.

Collateralised loan obligations (CLOs): Assets secured against a pool of bank loans.

Residential/commercial mortgage-backed securities (RMBS/CMBS): Assets secured against a pool of residential or commercial mortgages.

Commercial real estate (CRE) loans: Loans secured on commercial property such as offices, hotels, retail parks, industrial parks and leisure.

Supply chain/trade finance: Short-term credit provided to optimise working capital for businesses.

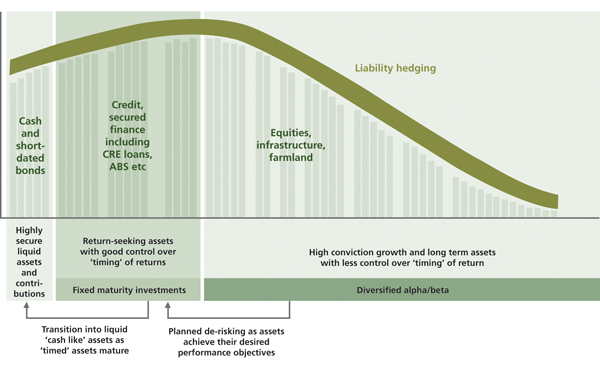

Figure 3: Using assets with fixed maturities can help pension funds maintain payments, while leaving scope for long-term investment

Source: Insight Investment. For illustrative purposes only.

How the strategy works: paying pensions while investing for growth

The characteristics of many secured finance investments may make them suitable candidates for inclusion in pension fund asset allocations, as they have the potential to help achieve the dual objective of paying pensions and investing for long-term growth.

When considering how to avoid being forced to sell return-seeking assets to meet cash flow requirements, we believe pension funds could benefit from an approach that makes use of investments with fixed maturity dates to meet short-term requirements while supporting long-term investment (see Figure 3).

One component of such a plan is to create a “drawdown pot” of assets, consisting of highly liquid, short-dated assets: for example, money market investments, cash and short-dated bonds. When the fund is required to pay income to retirees, it can use the drawdown pot to meet these requirements. For example, a pension fund might set aside a drawdown pot to cover the next five years of payments to pensioners.

The pension fund can design a plan to top up the drawdown pot over time, so that it will contain sufficient assets to cover near-term pension payments. A portfolio of assets with fixed maturity dates could help to achieve this goal: if a pension fund has a high level of confidence that assets will mature and generate a certain amount of cash each year, it can be confident that its drawdown pot can be sustained.

Having established these two components, a pension fund can then invest in assets for the long term with greater confidence that it will not be forced to sell them to meet cash flow requirements. Assets such as equities and infrastructure have the potential for attractive returns but they could be illiquid or their valuations volatile in the short term. If the fund is following the framework set out and maintains its drawdown pot, it can potentially leave such investments untouched and free to target performance required for a consistent funding strategy over time.

If long-term assets achieve or exceed their targets, a portion can be sold to reinvest in medium-term assets with fixed maturities. In other words, long-term investments could, over time, be converted to fixed maturity assets that will ultimately generate cash for the drawdown pot. Such a process can retain the upside generated by long-term assets while reducing volatility.

By following this approach, local authority pension funds can benefit from the targeted use of assets with defined maturities which offer the potential for an attractive return within a fixed timeframe. By doing so it is possible to construct a clear plan to ensure the fund can continue to afford pension payments without being forced to sell assets. Secured finance investments typically fit well into this framework; the underlying investments are structured with fixed maturities, interest is paid regularly and capital is repaid at maturity.

This article is intended for professional clients only. Any forecasts or opinions are Insight Investment’s own at the date of this document (or as otherwise specified) and may change. Material in this publication is for general information only and is not advice, proper advice (in accordance with the UK Pensions Act 1995), investment advice or recommendation of any purchase or sale of any security. The value of investments and any income from them will fluctuate and is not guaranteed (this may partly be due to exchange rate changes) and investors may not get back the amount invested.

Issued by Insight Investment Management (Global) Limited. Registered in England and Wales. Registered office 160 Queen Victoria Street, London EC4V 4LA; registered number 00827982.

Authorised and regulated by the Financial Conduct Authority.

© 2015 Insight Investment. All rights reserved.

More Related Content...

|

|

|