Opportunities in commercial real estate debt

|

Written By: Paul House |

Paul House of Venn Partners examines the opportunities in real estate debt that have emerged following a more cautious approach by banks to lending

The European financing landscape in commercial real estate debt has seen unprecedented changes over the last few years. New regulatory rules introduced as part of the spate of banking regulatory reform following the financial crisis have made it more difficult for banks to lend in certain sectors and beyond certain leverage points. On a global basis, the new Basel III rules require banks to strengthen their balance sheets by increasing bank liquidity and decreasing leverage. In the UK in particular, the FCA has introduced new rules, known as “slotting”, which require banks to allocate loans against commercial real estate to one of four categories (strong, good, satisfactory and weak), with the strength of the asset being inversely proportional to the amount of capital which needs to be held against it. Further, political and market pressure on banks to rebuild their balance sheets has resulted in a more cautious approach to lending in general, and against commercial property in particular.

This backdrop presents an interesting opportunity for fixed income investors who may not have considered investing in property debt as a potential source of yield and diversification from public and private corporate debt, with the added benefit of such loans being secured on real assets.

Significant refinancing demand

Against this backdrop, we foresee high borrower demand due to imminent, sizeable loan maturities. Borrower demand is also expected to result from increased volumes in portfolio sales from “bad banks” into private equity hands as borrowers look to refinance with longer-term lenders, with Cerberus alone acquiring over €17 billion of loans in 2014. Whilst 2014 saw unprecedented levels of commercial real estate and real estate owned transactions (€80.6 billion, over 2.5x the volume recorded for 2013), there is a long way to go with total non-performing exposures currently held on the balance sheets of “bad banks” across Europe increasing by €135.9 billion to €879 billion.1

This market environment presents an attractive opportunity for non-bank lenders to create a complementary lending offering to traditional bank lenders, and help address the existing supply-demand imbalance. Whilst only a few years ago, the UK lending landscape was dominated by banks with over 95% market share, non-bank lending reached 23% by mid-year 20142 and we expect this trend to continue over the next few years, increasing alignment with the North American model, where there is a mature non-bank lending sector to complement the bank offering.

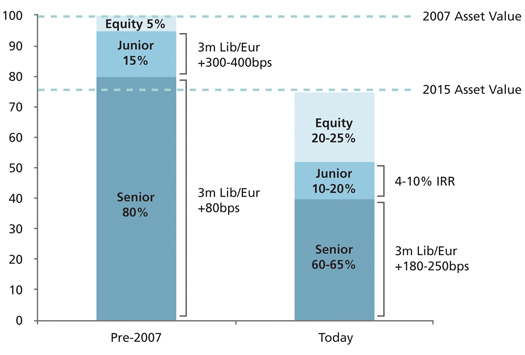

Figure 1: Real estate offers vastly improved credit protection

Source: Venn estimates as at April 2015

Valuations remaining historically reasonable despite yield compression in prime locations and senior loans

Whilst parts of the commercial real estate market are showing signs of over-heating (e.g. some prime offices in London) due to large amounts of capital (including lenders) chasing this type of product, there remains a number of opportunities that continue to offer excellent value and credit protection. As indicated in Figure 1 (over), valuations and respective loan amounts for these opportunities tend to be significantly down from their peaks, whilst equity buffers in today’s commercial real estate capital structure are significantly higher at 20-25%, compared to as low as 5% historically.

Attractive relative value

We believe real estate debt outside the focus of bank lending offers excellent relative value for investors. In particular, we currently see value in whole loans (0% to 75% Loan to Value) and mezzanine loans (60% to 75% Loan to Value), within 1) loans of smaller nominal amounts (typically below £50m), and 2) loans against assets with repositioning stories or operating risks, 3) bridge loans or 4) selective development loans.

Furthermore, the bespoke nature of private debt allows prospective lenders to contractually enhance credit protection and relative value. Borrower discipline may be ensured by building control mechanisms such as covenants, cash traps and sweeps and information reporting on an ongoing basis into the loan documentation.

1. Cushman and Wakefield: European real estate loan sales market, Q4 2014

2. The Commercial Property Lending Market Research Report – Mid Year 2014

Disclaimer

This document is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of April 2015 and may change as subsequent conditions vary. The information and opinions contained in this document are derived from proprietary and non-proprietary sources deemed by Venn Partners LLP (“Venn”) to be reliable, and are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Venn. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this document is at the sole discretion of the reader. This document contains general information only and does not take into account an individual’s or entity’s financial circumstances. An assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial or other professional adviser before making an investment decision. The information provided here is neither tax nor legal advice. Investors should speak to their tax professional for specific information regarding their tax situation. Venn Partners LLP is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

More Related Content...

|

|

|