Real estate’s recovery ramps up

Published: July 8, 2025

Written By:

|

Donald Hall |

Following a challenging period for real estate, a market recovery is gathering pace, creating attractive re-entry points for investors

Values are stabilising, returns are swinging to the positive and new supply is slowing. Institutional investors are being encouraged by signs of a sustainable real estate recovery, following a significant contraction from mid-2022 and late 2024. Global real estate capital flows to North America, Europe and Asia-Pacific rose 31% year-over-year to $37 billion in 20241, driven by expectations that political conflicts, interest rate risks or macro headwinds might ease.

Institutional investors remain uneasy, however, amid geopolitical instability caused by the Ukraine war, US tariffs and rapid escalations in the Middle East. But this is true across all asset classes – not just real estate.

Compared with other asset classes, real estate enters this period of uncertainty significantly de-risked, having gone through its own correction over the last two and a half years.

What’s driving the recovery?

The first signs of real estate’s rebound are rooted in three critical indicators – value stabilisation, improving total returns and a sharp drop in new construction. Values have reset significantly since the peak in 2022, down 16% on a global basis, according to Q1 2025 data from the MSCI Capital Growth Index. Across most countries, values are seeing marginal increases, suggesting they have found their floor.

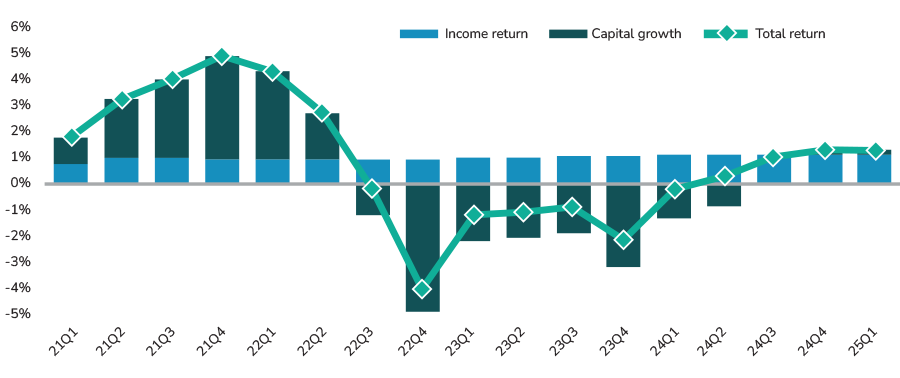

Figure 1: Global unlevered quarterly returns

Source: MSCI Global Quarterly Property Index (Q4 2024 data as of June 17, 2025 data release); Nuveen Real Estate Research.

The stabilisation has translated into improved performance metrics. Of the 21 countries in MSCI’s Global Property Index, all 21 reported positive total returns in the first quarter of 2025, and 19 delivered positive returns over the year. The recovery is also broad-based, cutting across both geographies and property types. In a breakdown of 50 country-sector combinations, 48 reported positive returns in the last quarter – a sign that the rebound is not only underway but widely distributed.

The slowdown in construction is another tailwind for market fundamentals. New construction starts have fallen off significantly, and as a result, new supply is set to be at the lowest level in over a decade across all sectors.

US sectors in the spotlight

While the broader market shows signs of recovery, certain sectors are emerging as clear outperformers. Retail appears to be an opportunity that is starting to gain traction with investors.

The industrial sector, though seeing a moderation in rent growth from pandemic-fuelled highs, still enjoys favourable long-term tailwinds. Additionally, many existing leases remain below current market rents following strong rent growth the last few years, providing a steady increase in renewal rents for years to come. Select markets including Charlotte, Columbus and Phoenix have asking rents over 35% above average prices. This supports income growth even as market rent moderates. The light industrial segment has held up particularly well thanks to less new supply.

Multifamily is rebounding following four consecutive quarters of demand outpacing supply, which has caused occupancies to improve in most markets around the country. Occupancies in the southeast of the US are still lower than normal as a result of oversupply, but demand has been strong and the recovery has begun. Meanwhile, major markets that faced challenges, such as Chicago and New York, are returning to favour thanks to strong fundamentals and improved rent growth.

Alternative sectors including medical office, self-storage and senior living all have different drivers but continue to offer diversification benefits for investors alongside the potential for outsized returns. Medical outpatient buildings have vacancies at all-time lows and an aging demographic should help support demand going forward, similar to senior living.

Investors looking to re-enter real estate may consider defensive property segments such as medical outpatient buildings, grocery-anchored retail, middle-market residential and light industrial in the US.

Europe and UK benefit from similar tailwinds

Western Europe is gaining interest from investors due to strong fundamentals, lower interest rates, greater probability of near-term rate cuts and potentially the catalyst of the region working more closely together. Property values reset further compared to other regions and are rebounding quickly and broadly across property types in recent quarters. Fundamentals are already tighter, as less new supply was delivered over the previous cycle. Additionally, local investors are close to their target allocation for the asset class and there are currently fewer active buyers, despite the compelling opportunity set in their home region. Overall, these dynamics are providing a wide opportunity set.

Opportunities across equity and credit

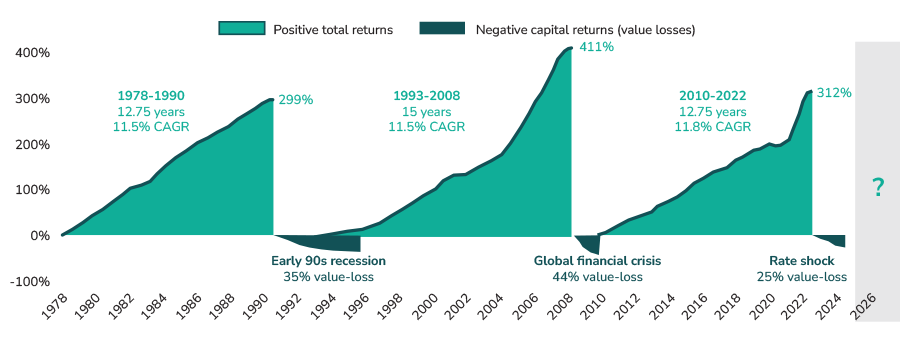

With values reset and fundamentals improving, this phase of the cycle represents a good entry point for long-term investors. There have been three major market upcycles in US real estate in modern times – 1978 to 1990, 1993 to 2008 and 2010 to 2022. In each of these periods, the market consistently delivered strong recoveries with average annual returns of 11.5%+ over periods of 13 to 15 years. Following a 25% decline in capital values over the last two years, similar conditions are emerging which suggest the potential for another long-term upswing (Figure 2).

Figure 2: Cumulative returns of US core real estate funds (NFI-ODCE)

Source: NFI-ODCE Fund Index, data as of Q1 2025

Although real estate equity investments are beginning to look attractive once more, real estate credit also looks favourable in today’s market. Conditions are attractive from a credit perspective – base rates are high; credit spreads remain wide and values have reset. Loans should continue to de-risk as asset values increase and loan-to-value ratios fall.

How are investors responding?

Nuveen’s 2025 EQuilibrium survey found that almost 40% of global institutional investors are planning to increase allocations to private real estate over the next two years, up from about 25% in 2024. Sectors in focus include data centres, industrial and residential. The survey highlighted a significant jump in interest for self-storage assets among investors planning to increase allocations to private real estate, from 16% in 2024, to 29% in 20252.

Conditions in place for a solid rebound

Global real estate’s recovery in 2025 is supported by tangible data and improving fundamentals. Stabilising values, positive total returns and historically low supply levels provide a solid foundation for renewed growth. Transaction volumes are on the upswing as investors begin to rebalance into the asset class. As of the first quarter of 2025, trailing 12-month transaction volume was up 20% in the US and Europe3.

Strategically, investors now face one of the more attractive entry points into real estate in recent years. Across equity and credit strategies, the opportunity set is broad. There are three primary risks in real estate – falling values, oversupply and weakening demand. With values reset and the peak of the supply cycle behind us, two of those three risks are substantially mitigated. Investors can manage the final risk by investing into sectors that have resilient demand drivers supported by long-term trends.

With values beginning to rise and supply levels dropping, 2025 may well materialise as the beginning of a new, rewarding cycle for global real estate investors.

Explore more real estate insights from Nuveen and the full range of real estate capabilities.

1. CBRE Research. (2024). H2 2024 global real estate capital flows. CBRE. https://www.cbre.com/insights/reports/h2-2024-global-real-estate-capital-flows

2. Nuveen, EQuilibrium Survey, 2025 https://www.nuveen.com/global/insights/equilibrium

3. MSCI Real Capital Analytics (Q1 2025)

More Related Content...

|

|

|