The big impact of small print in credit

|

Written By: Annabel Gillard |

Annabel Gillard of M&G Investments looks at how an in-depth knowledge of structured credit can open up opportunities in the asset class

Credit remains a core asset class for UK pension funds but, given that the total possible losses an investor could face almost always add up to significantly more than the total possible gains, the question could be asked: does this make sense?

The answer to that question is most emphatically “yes”, given the safety measures embedded within bonds, loans and other credit instruments. Such safety measures are unique to this asset class and are known as structural protections. They are: seniority – an advantageous position relative to other investors; security – a claim on assets pledged by the bond or loan issuer; and covenants – strict agreements that impose certain parameters on borrowing and behaviour.

Another way to consider structural protections is as a series of dials that an active fund manager can fine tune so that individually, in combination or collectively they work to not only counterbalance credit risk but also offer opportunities for gain.

The most pronounced opportunities for gain are available through investment in commercially viable but over-leveraged companies. In other words: instances of distress. Here, detailed knowledge of these structural protections, and an ability to negotiate on them, can unlock the potential for higher investment returns. A useful way to approach the value that structural protections can add for credit investors is to consider each “dial” in turn and then look at how they work in practice.

Seniority: knowing where you stand

Companies and other borrowers have long ranked their providers of finance by seniority. In simple terms, there should be lower risk and lower returns at the top of the structure and higher risk and higher returns at the bottom – a theory that places bondholders above shareholders.

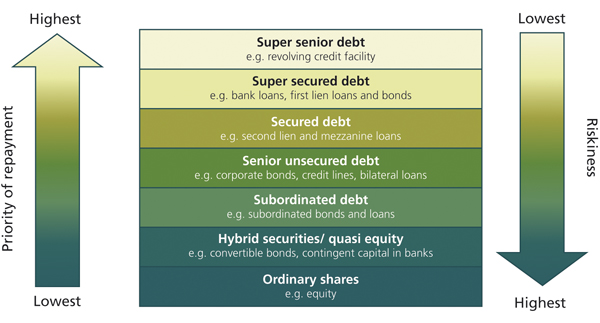

Figure 1: How seniority shapes a company’s capital structure

Source: M&G Investments

Many corporates have simple capital structures but once financial borrowers enter the equation more levels start to appear. Figure 1 offers, in very general terms, an example of the typical positions that an institutional investor in credit would be likely to encounter as they seek points and instances of value. It is worth noting that “senior” can appear in the middle of a capital structure – a stark illustration that seniority is a relative term. In fact many borrowers refer to “senior” instruments when raising capital from investors, which underlines the importance of detailed analysis on a case by case basis.

Such analysis and engagement should include how much other senior debt the borrower already has outstanding. Too much may dilute any benefits the investor hopes to gain from seniority.

To further complicate matters, a borrower issuing new senior debt in the future can subordinate existing senior bondholders. This risk can be addressed when the terms and conditions of lending are negotiated, before the point of actual investment. Senior investors should also ensure a borrower has the resources to repay their debt before junior bond holders. This is why junior debt usually has longer maturities than senior.

For credit investors with the skills and experience to assess exactly where they sit relative to other lenders, seniority becomes an essential yardstick for measuring relative value – and therefore generating attractive returns from the credit.

Security: the comfort of collateral

The second structural protection is security, where a borrower pledges assets that sit on its balance sheet as collateral against the value of a loan to reduce its risk. Such assets include houses, commercial real estate, equipment and vehicles. Items such as software or trademarks can also be employed as collateral – and even instances of forestry or chickens being posted as collateral have been known. The rule of thumb is that the riskier the borrower, the more likely lenders will want to invest on a secured basis.

So, public corporate bonds, standardised debt securities with a well-developed secondary market, are often unsecured. This is particularly the case with large multinational issuers that have low leverage and diversified earnings.

In certain areas of private debt, security offers valuable protection given the illiquid and frequently longer-term nature of the investments. In the social housing sector, for example, a recent private debt investment by M&G’s fund managers saw a £75 million loan to County Durham Housing Group for a 25-year term. The housing association is posting as collateral against its borrowing a portfolio of over 18,000 houses, flats and bungalows that were the subject of a recent large scale voluntary transfer to the housing group from Durham City Council – in an arrangement that is fairly typical of institutional investment in social housing.

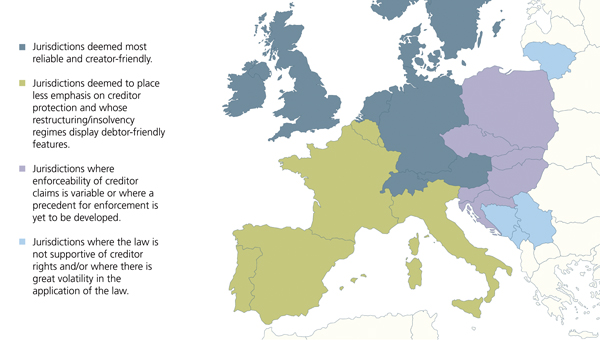

Figure 2: Some of the main features of the legal frameworks that affect the way in which an investor makes a claim for collateral in Western Europe

Source: Fitch

Investment in UK secured assets can bring many advantages – as can investment in international secured assets, although the latter can also come with crucial regulatory and legal differences that must be factored into analysis and valuations. Some of the main features of the legal frameworks that affect the way in which an investor makes a claim for collateral in Western Europe are illustrated in Figure 2.

Notwithstanding such legal niceties, the truth remains that secured lenders will always have a recognisable claim over assets and this can be of great help in a worst-case scenario.

Covenants count

The third “dial” is covenants. They are vital clauses that allow investors to monitor a borrower’s behaviour during the life of a loan. They can flash up early warning signals that things might not be going to plan and can enable lenders to step in to discuss any of these issues with the borrower before a drama turns into a crisis.

As with all structural protections, covenant packages can differ widely between debt asset classes. For private investments, such as direct corporate loans or private placements, they are critical, and investors often negotiate them at the outset of the loan. In more liquid areas of private debt, namely leveraged loans, investors typically prefer a strong covenant package. And even in public corporate bond investment, covenants are considered necessary to curb irresponsible borrower behaviour.

There are two main types of covenant. The first, incurrence covenants, restrict a borrower’s ability to increase the level of their indebtedness beyond a specific level. This, for example, helps to ensure that what is a good investment when debt is low does not become a very bad investment by the addition of much more debt to the company.The second type of covenant, maintenance covenants, are periodic tests of the borrower’s financial metrics, so that every three or six months a borrower must meet pre-agreed criteria.

For example, during the financial crisis, the Switzerland-based chemicals group Ineos breached maintenance covenants on a loan. Loan holders were able to enter negotiations at a very early stage with the company to assess the cause of the breach, agree more headroom under the covenant and secure a higher interest rate on this debt to reflect its elevated risk. Such an outcome was not available to holders of the company’s bonds.

Structural protections and distressed debt

When a borrower’s operational performance takes a turn for the worse, the amount of debt it has to service and repay can become a strain. Should things fail to turn around, the company’s debt burden may become unsustainable and the market price of its debt will often plunge. At this point, the issuer may be described as “stressed” or “distressed”, and a default or debt restructuring becomes likely. This is where structural protections can come together to unlock value. Here, the level of security, seniority and covenants will play a huge role in determining the future structure of a borrower’s debt and the amount recovered by investors.

In some cases, where the underlying business is sound, an investor able to wield influence during a restructuring can help shape a strategy that cuts its debt down to size and allows the company to recover. A good restructuring can make an investment even more attractive, because a company’s recovery back to health can bring substantial capital gains and, if debt is converted to equity, considerable upside in the equity value.

At this stage in the credit cycle, there are a large number of interesting stressed and distressed situations for investors who have the legal and credit skills to understand, shape and profit from structural protections. But, all investors in credit can benefit from the structural protections offered by this asset class. Understanding the small print can unlock significant benefits both in increasing potential upside as well as managing risk more effectively.

For Investment Professionals only.

The distribution of this article does not constitute an offer or solicitation. It has been written for informational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. Opinions are subject to change without notice.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority. 0398/MC/0415

More Related Content...

|

|

|