The case for multi-sector credit

|

Written By: Michael Temple |

|

& Jonathan May |

Michael Temple and Jonathan May of Pioneer Investments make the case for a strategy that provides a comprehensive approach to risk management

Over the past decade, local government pension schemes (LGPS) have looked to diversify and adopt alternative sources of growth in order to reduce their reliance on volatile equity markets. Many opportunities within the wider fixed income market such as investment-grade corporate bonds, high yield and emerging market debt became candidates for growth.

However, the search for diversification has brought with it a challenge of governance for pension schemes. The regular cycle of investment meetings and procurement regulations do not easily allow tactical asset allocation. Schemes need to develop expertise to determine asset allocation between the different sub-sectors and effectively monitor portfolios and markets in order to take advantage of arising opportunities. This presents a significant challenge for schemes. We believe a solution is for schemes to look to skilled, experienced investment managers to make these decisions in the context of a broad credit mandate using an appropriate risk management framework.

Credit – the opportunity set

The credit space is formed from a variety of asset classes, all of which have slightly different characteristics. These different features mean that there are times when some areas are typically more attractive than others are. Credit opportunities include:

Investment-grade Corporate Bonds

Relatively strong, creditworthy companies. The lower levels of risk are reflected in their returns offering a slight premium over government bonds.

Loans

The next asset in the capital structure after investment grade bonds. Typically, they are characterised by less liquidity and potentially higher returns than investment grade and with higher recovery rates than high yield bonds.

High Yield

Lower down the credit spectrum than investment grade. This area has seen significant inflows in the last few years, encouraged by relatively low default rates on an historic basis. Investor enthusiasm for yield has led to spreads tightening and many would argue valuations are less compelling than in recent years.

Emerging markets debt

Emerging market sovereign and corporate bonds have been an increasing source of new debt issuance. The asset class has not been without its challenges – particularly over the last 12 months. While there has been progress in corporate and sovereign balance sheets, the sector is not homogenous. For example, China has relied heavily on (low-margin) manufacturing, India on (higher-margin) technology services, Russia on energy, and Brazil on agriculture. China and India are people-rich; Brazil, Russia (and the Middle East) are resource-rich. Movements in the US dollar also influence flows into the asset class. This was evident in May 2013 when hints from the Federal Reserve Chair about the end of quantitative easing sent the asset class into a tailspin.

Event-Linked Bonds

Higher yielding instruments linked to the insurance markets. They offer diversification, as performance is not related to any other asset class in financial markets. Nevertheless, if an insurance event occurs, holders can lose some or all of their principal and any unpaid interest payments. This happened to many funds that owned bonds linked to US hurricane risk when Hurricane Katrina struck.

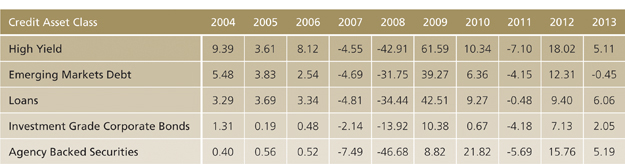

Without doubt one could argue that an investment case would be made for all of these asset classes at some point in time; however, as the table above shows no one credit asset class has consistently outperformed over the last decade. The skill is being in the right place at the right time.

Figure 1. Credit assets perform differently in different market conditions

Source: Merrill Lynch Data (ENOO, Head EBSU) 30/06/2013, Credit Suisse Loan (Credit Suisse Western Europe) and Barclays ABS (ABS Bond Index ex AAA) 31/12/2012. Floating Rate Loans and ABS are total returns excluding Euribor

Right place, right time

As Michael Temple, Pioneer Investments’ Boston-based Head of Credit Research says, “Market dislocations occur frequently and can either be valuation based – for example, a certain sector suddenly appears cheap based on relative market pricing moves, or structural – perhaps due to central bank, political, regulatory, or industry disruptions.”

One opportunity that arose was the result of the financial crisis in 2008. Identified by many as the root of the crisis, the Non-Agency Mortgage Backed Securities market in the US post-2008 presented a tremendous opportunity. Previously, the asset class was considered to be relatively safe and was used to develop complex financial structures that were sold to investors looking for cheap, yet highly-rated securities. This sector imploded as banks and other investment organisations were forced to reduce their leverage, selling these securities into an illiquid market. As with all market dislocations, good securities are inevitably lumped in with bad securities, creating an investment opportunity for those with the skillset to identify both the right timing and securities to own.

Investors that did not have the ability to identify these types of opportunity, and act accordingly, inevitably missed out on the significant recovery that took place subsequently. Within our Multi-Sector Credit strategies, we avoided the lowest quality issues ahead of the meltdown, due to poor valuations. But after 2008, we were able to identify, and then sought to invest in, the most senior, creditworthy areas of this sector. We were able to take advantage of this opportunity because of our resident expertise, willingness to go against conventional wisdom based on confidence in our research, and our ability to dispassionately compare and contrast opportunities across a broad set of markets and sectors.

Holistic oversight

Ultimately, this example illustrates our belief that schemes need to be invested in strategies that are nimble and able to take advantage of opportunities whenever and wherever they arise in the credit universe. However, another compelling reason to invest in a strategy that adopts a multi-sector approach is the ability to employ a comprehensive approach to managing risk. This is even more important in the current environment when there is limited compensation for credit, significant interest rate risk, and uncertain liquidity. Comparing and balancing exposure to the range of sectors seeks to reduce overall volatility and improve the risk/reward profile.

Multi-sector credit for the LGPS

A number of UK schemes within both the corporate and local government sectors have recognised these advantages and awarded multi-sector credit mandates over the last couple of years.

As Jonathan May, our Head of UK Institutional Business explains, “The search for investment opportunities continues, and many schemes are finding the challenges of governance increasingly difficult to manage. We have already seen aspects of outsourcing, particularly with the rise of fiduciary or delegated management in the corporate sector, as well as the rise in allocating to diversified growth funds. However, for those that would like to maintain some level of control with their decision-making process when allocating to credit markets, multi-sector credit strategies may offer a solution.”

“They give the scheme exposure to the growth opportunities available in the fixed income markets, while allowing the investment manager the flexibility to adapt the portfolio to invest in the sub-sectors where they believe those opportunities lie.”

Unless otherwise stated all information and views expressed are those of Pioneer Investments as at June 13, 2014. These views are subject to change at any time based on market and other conditions and there can be no assurances that countries, markets or sectors will perform as expected. Investments involve certain risks, including political and currency risks. Investment return and principal value may go down as well as up and could result in the loss of all capital invested. The investment schemes or strategies described herein may not be registered for sale with the relevant authority in your jurisdiction.

The content of this document is approved by Pioneer Global Investments Limited. In the UK, it is approved for distribution by Pioneer Global Investments Limited (London Branch), Portland House, 8th Floor, Bressenden Place, London SW1E 5BH, Pioneer Global Investments Limited is authorised and regulated by the Central Bank of Ireland and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority (“FCA”) are available from us on request. Pioneer Investments is a trading name of the Pioneer Global Asset Management S.p.A. group of companies.

More Related Articles...

More Related Articles...

|

|

|