|

Written By: Graham Stock |

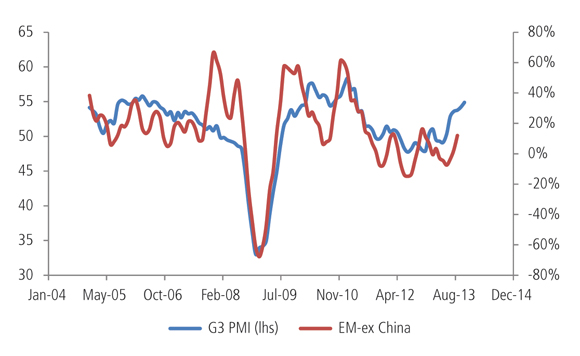

The balance of risks for emerging markets in 2014 is finely poised. In our view, rising developed market GDP growth should continue to boost exports from emerging markets and prompt a rotation into faster growth there as well. This process will occur with shorter or longer lags, depending on the structure and trade linkages of the individual economies. The correlation between emerging market exports and core market PMI (G3) readings, however, is robust and points to further export growth in coming months (Figure 1). We are already seeing a pick-up in manufacturing exports from Central Europe to Western Europe, for example, and from the high-tech economies of South East Asia to their core markets in Europe and the US. The Mexican recovery, on the other hand, has so far been hampered by the low-tech nature of the US manufacturing upswing to date, because the sectors that have led the expansion north of the Rio Grande have few linkages with the “maquiladora”1 industries that have boomed in the twenty years since the North American Free Trade Area took effect. But there is no reason to suspect that the US recovery will not broaden out to benefit its neighbour more in the coming months, which is one reason why we believe spread assets and the currency should do well there in 2014.

Figure 1: EM ex China Exports, 3m/3m seasonally adjusted annualised rate

Data source: Haver, BlueBay Asset Management

Having triggered the global financial crisis by running up excessive debt levels and stimulating poor lending decisions, it is no surprise either that developed markets suffered the sharpest output falls, or that they should finally be returning to some modicum of vigour after extended policy therapy. As a result, they are expected to account for almost half of global growth in 2013-14 after generating as little as a quarter since 2008. The structural factors that underpinned faster emerging market growth over the last twenty years remain in place in many cases, but inevitably the relative pace should be expected to slow as catch-up occurs. Relative wage levels and productivity growth on average are no longer as skewed in favour of emerging markets. Indeed, many markets that are still termed “emerging” have overtaken so-called advanced economies on measures including per capita incomes and broader measures of living standards. We believe a next generation of emerging markets, often grouped together as the frontiers and concentrated particularly in Sub-Saharan Africa, will instead be the countries that post 5-10% growth rates over the coming decades.

The main risk that could prevent investors from harvesting the fruits of a more positive macroeconomic environment would appear to be a re-run of the Federal Reserve taper tantrum that rocked risk assets, and particularly emerging markets fixed income, in May-August of 2013. Certainly there are a number of countries that continue to depend on portfolio inflows to finance current account – and to some extent budget – deficits, and are therefore vulnerable to tighter global liquidity which makes such inflows less likely. Brazil, Turkey, South Africa, India and Indonesia are significant emerging markets and in 2013 were tagged the “Fragile Five” precisely because they suffer from just such a dependence.

Can too much growth be bad for you?

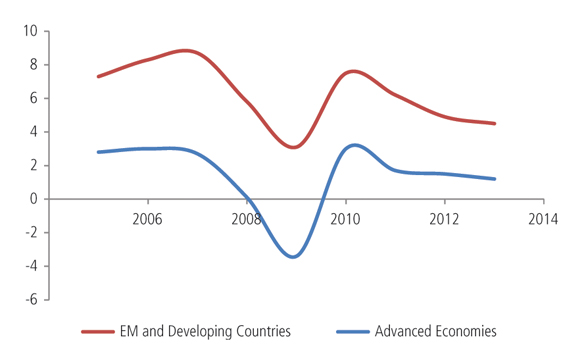

Between 2005 and 2013, IMF data shows that emerging markets and developing countries grew at an average annual real rate of 6.3%, while advanced economies only managed to average 1.4% growth (Figure 2). This relative strength of emerging markets’ economic performance, supported by buoyant commodity prices and the stimulative policies of the advanced economies, may have led to complacency on the part of policymakers when they could have been pushing ahead with a more reformist, pro-growth agenda. Equally some arguably sought to emulate the expansionary fiscal stance of G8 governments, even though their own circumstances did not warrant such generosity.

Figure 2: Year-on-year real GDP

Data source: IMF, BlueBay Asset Management

The rise in US interest rates and portfolio outflows in the summer of 2013, which in turn triggered bouts of currency weakness and upward pressure on yields, therefore proved a useful wake-up call. Responses included: tighter monetary policy (in Brazil, India, Indonesia and to some extent Turkey), intervention in currency markets using large reserve buffers accumulated in the boom years (in Brazil and India), a heightened focus on facilitating infrastructure investment (again in Brazil and India), and benign neglect (in South Africa above all, where currency volatility is the norm at times of external stress, but domestic macro-prudential standards are high).

In all of the “Fragile Five”, the governments are constrained by the domestic political timetable (Figure 3). The election outcomes themselves do not pose significant political risk for investors. If anything, a move to more market-friendly policy stances is likely to result. But in the run-up it will be harder for the authorities to cut budgets or tighten monetary policy as aggressively as might be warranted by a more challenging financing environment.

Figure 3: Swing-o-meters at the ready for 2014

Data source: BlueBay Asset Management

Political risk is sustenance to experienced emerging markets investors. The campaign noise and short-term cyclical economic outcomes can mask more important secular trends. Sometimes local investors and newer offshore participants will be excessively optimistic or pessimistic about the likely election result, reflecting their own political preferences rather than a more detached assessment of the probable policy stance of an incoming government. We saw this when Lula’s Workers’ Party first won office in Brazil in 2002, and there are echoes of the same scepticism in the run-up to a fourth consecutive likely PT (Workers’ Party) victory in the 2014 election, although the current PT administration is also struggling to deliver Lula’s preferred mix of pro-poor spending with overall fiscal discipline.

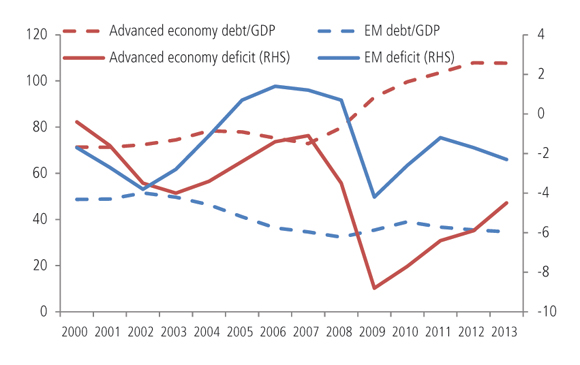

The most important secular trend, and the one that underpins our confidence in the outlook for the asset class, is that the balance sheets of emerging market sovereigns are generally in fine shape (Figure 4). Gross government debt across emerging markets has dropped by a third since 2000, while in advanced economies it has risen 50%. Having blown out their deficits in 2008-09, the advanced economies still borrowed 4.5% of GDP to finance budget deficits in 2013, while the average emerging market borrowed just 2.3%. And the latter are growing more than three times as fast, so they can borrow such sums while still bringing down their debt/GDP ratios.

Figure 4: General government balance sheets better in – emerging markets and advanced economies

Data source: Prytania Investment Advisors LLP, IMF, BlueBay Asset Management

The asset side of the sovereign balance sheet also looks significantly stronger than ever before. Official emerging market FX reserves are set to top US$9 trillion in 2014. These are concentrated in Asia, but even Brazil has accumulated around US$375 billion, sensibly taking advantage of the terms-of-trade gains from the commodity price boom of the last decade. As a result, the threat of a generalised balance of payments crisis across emerging markets, as we saw in the aftermath of the 1970s oil price shocks and early 1980s Federal Reserve monetary tightening, looks remote.

The reform process may have slowed in some countries, as noted above, but elsewhere it is still breaking new ground. This bolsters confidence in the continued health of these emerging market balance sheets, and suggests that the asset class’s average credit rating of BBB is secure. In China, for example, the recent policy plenum set out a liberalisation agenda that should shore up growth rates at home and in many other emerging markets trading partners. In Mexico, the new PRI government has initiated reforms in education, telecommunications, fiscal policy and even the hitherto protected oil sector.

Finally, we note that emerging markets fixed income technicals are attractive. It remains an underinvested asset class. JP Morgan estimates that US pension funds and life insurers allocate just 3-4% of their fixed income portfolios to emerging markets, even though they already account for more than half of global output. The local institutional investor base also continues to grow rapidly following pension reforms and the development of local insurance markets over the last couple of decades, and is now estimated to total around US$5.5 trillion.

Both these sources of demand for emerging market bonds issued by sovereigns and corporates, in hard and local currency, look set to expand further in 2014 and beyond. In any case, though, in aggregate the positive cash-flow resulting from coupons and amortisations in 2014 appears sufficient to absorb all expected sovereign issuance over the course of the year. In this context, yields of 5.9% on the hard currency sovereign benchmark (JP Morgan’s EMBI Global Diversified) or 6.7% on the local currency benchmark (JP Morgan’s GBI-EM Broad), continue to compare very favourably with 4.2% for US high grade (JP Morgan US Liquid Index), or 6.0% for the much lower-rated US high yield market (JP Morgan Domestic High Yield Index).

1. An assembly plant to which foreign materials and parts are shipped and from which the finished product is returned to the original market.

More Related Articles...

Published: January 1, 2014

Home »

Emerging Markets