Intelligent capital allocation – an overlooked concept in investing

|

Written By: Stephen Way |

Stephen Way of AGF Investments outlines the importance of investing in firms that understand the importance of their capital allocation decisions

We believe capital allocation is the most critical way company management teams add (or destroy) value for shareholders. This process of capital allocation or, more simply put, the process by which financial resources are disbursed among different projects, has a significant impact on shareholder wealth. Indeed, we have found that, over time, the returns enjoyed by shareholders are primarily a function of management’s decisions about capital expenditures, dividends/share buybacks, and merger & acquisition (M&A) activity as well as the level of debt and equity used to finance the business.

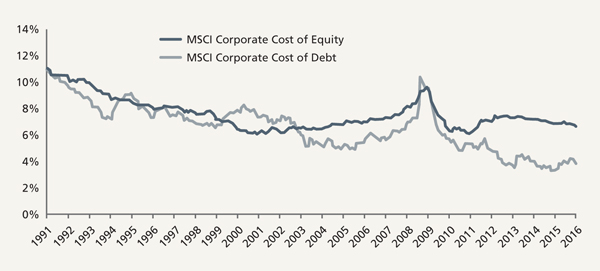

The question of capital allocation is particularly important today given a lacklustre growth environment and accommodative central bank policies. A lacklustre growth environment means that top-line sales growth remains challenged, leaving companies scrambling to find ways to engineer growth. Additionally, accommodative monetary policy has resulted in an unprecedented low cost of debt, which has made it easier for companies to obtain financing. As the cost of debt has fallen consistently over the last 25 years, the cost of equity has remained unchanged for the last 15 years and we now have the widest gap in history between the cost of debt and the cost of equity (Figure 1). This environment is incentivising companies to borrow to fund M&A activity and share buybacks, with a commensurate increase in leverage. In such an environment, prudence is required; how companies deploy capital will be a key determinant of how they will fare when interest rates start to increase or if growth remains lacklustre. Put another way, where companies choose to invest today will in a large part determine their long-term returns for shareholders.

Figure 1: Cost of debt vs cost of equity

Source: Citi Research, Datastream. *Average of United States and Europe. March 24, 2016

Capital deployment alternatives

Capital is typically deployed to various uses, including M&A activity, capital expenditures/research and development, cash dividends and share buybacks. As each of these deployment alternatives have their own benefits and pitfalls, we evaluate their merits below.

Mergers and acquisitions (M&A)

M&A is a significant use of capital, although the level of M&A activity varies across business cycles. 2015 was a particularly strong year for M&A activity globally, buoyed by a low-interest environment, improved CEO confidence and a search for growth.

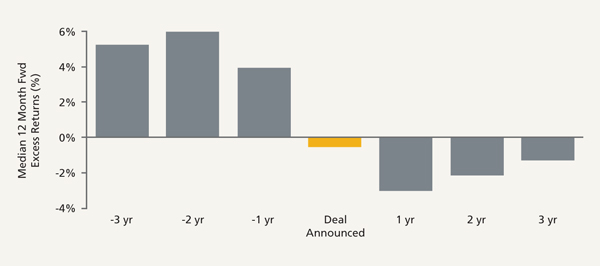

Given the recent surge in M&A activity, it is important to ask the question – has M&A activity historically benefited shareholders? Research by Credit Suisse found that in the three years following a material transaction, the median firm underperforms by 1-3% after outperforming by 4-6% in the preceding three years (Figure 2).What is particularly concerning today is that the recent surge in M&A activity has been accompanied by an increase in debt levels. Companies have raised almost US$290 billion of debt to purchase competitors, almost triple the level of the same period in 2014.1

Figure 2: Global excess shareholder returns for acquisitive firms

Source: Credit Suisse HOLT: Worth the Premium? January 2015. Tom Hillman and Chris Morck. Universe: 9,972 global acquisitions 1992-2010

When evaluating M&A transactions, we focus on “value accretion” or the ability of the acquisition to generate cash flows that are greater than the amount paid for the company, in present-value terms. Simply put, in order to create shareholder value, a company should get more than what they pay for. Ultimately, we look for transactions that can cover the cost of capital within a three- to five-year period. This may sound relatively straightforward, yet the reality is that a large number of acquisitions do not meet this criteria, hence the relatively high failure rate of M&A transactions.

Capital expenditures

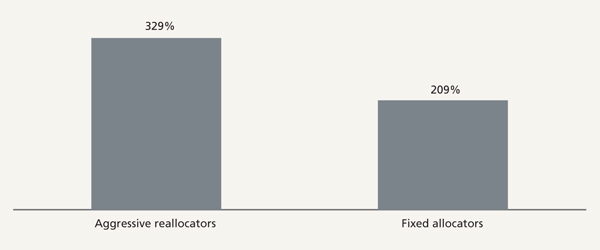

Capital expenditure (capex) is another common use of capital, although it tends to be less variable than M&A and dividends/share buybacks. When it comes to capex spending we have found that management teams that are judicious re-allocators of capital tend to do better over the long term. These companies redeploy capital from divisions that do not earn sufficient returns and allocate it to the higher return business units. This concept is well supported by research – a study by McKinsey showed that over a 15-year period, companies that shifted more than 56% of their capital across their business units outperformed those that simply made small adjustments but always followed the same investment pattern (Figure 3).

Figure 3: Companies with higher levels of capital reallocation experienced higher average shareholder returns 1990-2005

Source: McKinsey & Company, March 2012. 1,616 companies examined

Asset divestitures

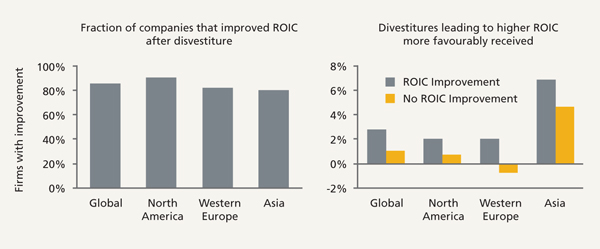

It is worth touching upon the subject of divestitures as they are an important avenue through which management can improve the capital efficiency of their business. This is because, while asset growth is an important driver of economic profits, the ability to generate attractive returns from deployed capital is just as an important. An asset sale provides management the opportunity to redeploy resources from businesses that earn returns below their cost of capital (value destructive) to more profitable business units that earn returns well above their cost of capital (value enhancing) and in turn improve economic profits. Research by CitiGroup found that 86% of firms conducting asset sales in the period between 2010 and 2016 experienced improvements in their ROIC. More importantly, firms exhibiting a return on invested capital improvement after divestiture outperformed the market, generating short-term excess returns of approximately 3% (Figure 4).

Figure 4: Favourable equity investor response to firms exhibiting ROIC improvement after divestiture

Source: SDC and Fact Set, Citigroup Global Markets, July 2016

Share buybacks and dividends

Another common use of capital is share buybacks and dividends. Spurred by low interest rates, buybacks and dividends have been on the rise. In 2015, buybacks and dividends accounted for 90% of net income in the United States, about 80% in Europe and about 40% in Japan.2

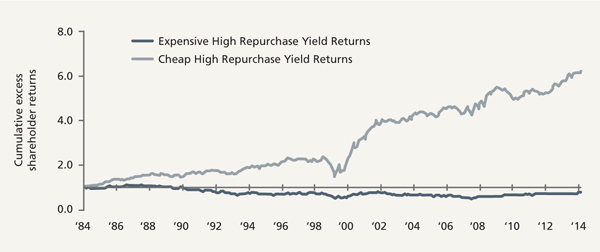

The premise of buybacks is that repurchasing shares when the shares are cheap benefits shareholders. In fact, a study spanning a 30-year period found that companies that repurchased shares when they were attractively valued significantly outperformed those that repurchased when their shares were expensive (Figure 5).

Figure 5: Repurchasing stock when shares are undervalued yields excess returns

Source: Credit Suisse HOLT: Cash Deployment Trends and Chartbook, December 1, 2015. Ron Graziano and Chris Morck. Universe: United States >US$1B

The reality, though, is that management teams tend to repurchase shares when their shares are expensive, which erodes shareholder value. For example, buybacks last peaked in 2007, just before the market crash, whereas few firms bought in 2009 when shares were cheap. Further, since 2009, the level of share buybacks has continued to increase just as the S&P 500 has moved higher.

We generally prefer buybacks and dividends to M&A transactions given the lower risks of execution. However, we are watchful of companies increasing leverage to fund buyback activity as this increases the risk profile of companies. Repurchases should also not be done in order to prop up the share price, but rather because they offer the most attractive alternative for allocating capital at a particular time.

Management compensation

Incentives are an important driver of management’s capital allocation decisions. For this reason, we pay particular attention to the incentive schemes of the companies we invest in. Case in point, a survey of 400 chief financial officers in the United States found that management teams were less likely to invest in a project that had a positive net present value (that is, that boosted long-term value per share) if this resulted in the company missing earnings estimates.

We look for compensation packages that focus on capital efficiency measures, such as return on capital, as they force managers to focus on long-term shareholder wealth creation. Return on capital, defined as net operating profit after tax/capital employed, is also associated with a higher Cash Flow Return on Investment and can help guide management toward projects that are value accretive. In fact, a study by Mukhchaou and Hillman indicates that the use of return of capital as a management incentive measure leads to a boost in shareholder returns by over 20% within four years of adopting return on capital as a performance measure.3

Conclusion

Overall, we believe capital allocation is management’s most important responsibility and look for management teams that display an unwavering focus on long-term value per share. To assess management’s skill in capital deployment, we:

- Analyse how the team has allocated capital in the past

- Assess the ability to drive incremental cash flow return on investment from new investments

- Review incentives to assess the degree to which they encourage long-term value creation

Ultimately, intelligent capital allocation is about understanding the long-term value of an array of opportunities and putting money to its best use. We believe that outstanding companies are those that know how to deploy capital well and have a discipline that is untethered by prevailing market trends. With a tepid economic environment and the risks of elevated debt levels lurking in the background, as well as the uncertain consequences of the unprecedented degree of monetary stimulus, now is the time to be investing in companies that understand the importance of their capital allocation decisions.

Disclaimers

The commentaries contained herein are provided as a general source of information based on information available as of August 15, 2016 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed.

Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. The information contained herein was provided by AGF Investment Operations. It is not intended to be investment advice applicable to any specific circumstance and should not be construed as investment advice. Market conditions may change, impacting the composition of a portfolio. AGF Investments assumes no responsibility for any investment decisions made based on the information provided herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA).

Past performance is not necessarily a guide to future performance. The value of investments and the income from them can fall as well as rise. Investments denominated in foreign currencies are subject to fluctuations in exchange rates, which may have an adverse effect on the value of the investments, sale proceeds, and on dividend or interest income. Investors may not necessarily recoup the full value of their original investment. Investors should be aware that forward looking statements and forecasts may not be realised.

AGF International Advisors Company Ltd. is authorized by the Central Bank of Ireland, in Ireland, and is regulated by the Central Bank of Ireland for conduct of business rules in Ireland, and regulated by the FCA for conduct of business rules in the UK.

For accredited investors only.

Publication Date: August 18, 2016

1. Dealogic, January 2016

2. www.investmenteurope.net/opinion/japan-equity-outlook-2016/

3. Credit Suisse HOLT: Alex Mukhachou, Tom Hillman. Do Return on Capital Incentives Drive Improvement? November 2015. Universe: United States >US$5B Mkt Cap

More Related Content...

|

|

|