Lessons from efforts to strengthen audit quality

|

Written By: Natasha Landell-Mills |

Auditors play a vital role in ensuring investor interests are protected. Natasha Landell-Mills of Sarasin & Partners explains the processes involved

In September 2014 Tesco Plc revealed that it had overstated its first half profits by over £250 million, equivalent to about a quarter of the total. The share price promptly fell by c25%. The Serious Fraud Office is investigating whether Tesco fraudulently overstated revenue, and the Financial Reporting Council is looking into the role of the auditor – PricewaterhouseCoopers (PWC). PWC is already under investigation for its part in reporting to the Financial Services Authority on behalf of Barclays Bank PLC.

The audit of company accounts is undertaken for shareholders to provide reassurance that the numbers presented by management are reliable. These numbers lie at the heart of our system of corporate governance: shareholders use this information to hold executives to account. Auditors, therefore, play a vital role in ensuring investor interests are protected. It should go without saying that it is critical that auditors are completely independent of the companies they are tasked with auditing.

And yet, investors have been repeatedly disappointed. The financial crisis has provided perhaps the starkest evidence of a systemic problem with audit. In the EU alone, between September 2008 and the end of 2010, 114 banks received capital injections in some form. None of these banks received a qualified audit report, and some had received clear audits just weeks before going cap in hand to government. Shareholders lost billions.

The failure of audit firms to forewarn investors of the problems brewing at companies is a very serious market and governance failure. Not only does it have grave repercussions for investors in the affected companies, but it has impacts for macro-economic stability and, in turn, can impact on the broader investment landscape.

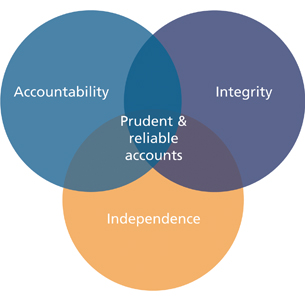

Figure 1: Audit is critical for shareholder protection

Source: Sarasin & Partners

An investor coalition to reform audit

A group of long-term investors (including Sarasin & Partners) representing over €2 trillion in assets therefore came together to urge regulators in the UK and Europe to take firm action.

It was, and continues to be, the group’s view that, at its heart, the failure of audit results from a lack of transparent accountability to shareholders and excessive closeness to management. The group called for greater disclosure to shareholders by the auditors and the Audit Committees; audit firm tenure to be capped at 15 years; and a limit to the amount of non-audit work undertaken by the auditor for executives.

Whilst there is unlikely to be a “silver bullet” in tackling the deep structural problems in the audit sector, it is our view that taken together these measures would go a long way to re-establishing auditor independence from management and, critically, accountability to shareholders.

Did regulators listen?

It is never easy to gauge the impact of policy outreach. However, we feel that we can point to clear success in our audit initiative.

Most significantly, the European Parliament finally passed into law far-reaching reforms to the audit sector in the Spring 2014 which were closely aligned with our requests. The package of measures included a hard cap on audit firm tenure at a client of 20 years (24 years for joint audits), with a competitive tender held at least every 10 years. A limit was placed on the amount of non-audit work permitted (equivalent to 70% of the audit fee), with certain non-audit activities (like tax advisory) deemed to create excessive conflicts of interest banned outright. New requirements for auditors and Audit Committees to report to shareholders were introduced, and new powers were awarded to shareholders to initiate the dismissal of an auditor.

In the two years leading up to the final vote in Europe, we reached out to members in the European Parliament across the political spectrum to provide a long-term investor view and met with Commissioner Barnier, who was responsible for initiating the legislation. We also sought to emphasise the importance of reform to member states represented in the European Council.

In parallel with our efforts to shape policy in Europe, we made a number of submissions and presentations to UK regulators and the UK Competition Commission (now the Competition and Markets Authority), which was investigating the market for “large” audits. Our views were reflected in the UKCC’s proposed remedies. The UK’s audit regulator, the Financial Reporting Council, eventually also moved to tighten its rules: the recent fines highlighted above are a clear result of this, as was the decision to introduce a requirement for competitive tenders for auditor every 10 years in the Corporate Governance Code.

Throughout the period of outreach our efforts attracted increasingly positive commentary by the mainstream British and European press, reflecting the effort we have made to communicate our positions and the rationale behind them. The Financial Times’ editorial team called for mandatory audit rotation to ensure we “audit the auditors” – one of our core proposals – and urged the UK Competition Commission to act. Members of our investor coalition were also referred to as “pension stars” for their efforts to reform the sector.

Winning the argument in the public media is enormously important to our outreach effort.

An independent audit must be underpinned by prudent accounting standards

Our work on audit is one powerful example of investor ability to shift the policy debate at a national and European level. Another is our work on accounting standards, where we have joined forces with a group of long-term investors and asset owners to call for a return to prudence in accounting. It is vital that shareholders (and the public) have a reliable view of the capital held within companies, and are assured that performance has not been overstated.

So far we have seen the matter taken up by the UK’s Parliamentary Commission on Banking Standards, the European Commission, the European Parliament and the International Accounting Standards Board. We hope that this work will catalyse a fundamental shift in how International Financial Reporting Standards are applied throughout the EU.

Policy outreach should be a core component of stewardship

Government policy can significantly affect prospects for sustained earnings generation in our clients’ holdings. Bad policy can contribute to macroeconomic instability, sector uncertainty, damaging corporate governance, and equity market volatility.

Where government policies or marker practices are at odds with long-term investment performance (and we believe we are in a position to shape the direction of travel) we believe it is vital to reach out to policymakers in order to improve performance for our clients. Our policy outreach on audit and accounting demonstrates what can be achieved.

The challenges, of course, should not be underestimated, especially when we seek to confront vested interests intent on protecting the status quo. And, of course, we cannot engage on every policy initiative being debated by governments.

But the broad set of policy outreach opportunities should not become an excuse for inaction. Rather, it should focus the mind. A strategic approach that focuses where it matters most, and where we are in a position to catalyse change – often by working in coalition with other like-minded investors – can deliver tangible results.

In the end, we will be most successful when our interests are most aligned with the public interest, and we are able to win the argument in the court of public opinion.

More Related Articles...

More Related Articles...

|

|

|