Multiple challenges set to characterise equity markets

|

Written By: Nick Clay |

Prolonged low interest rates and continuing difficult economic conditions provide the opportunity for dividend yield to provide much-needed comfort for investors. Nick Clay of Newton, a BNY Mellon company, tells us more.

We continue to believe that world equity markets will be volatile in 2013, with any number of hurdles to overcome. However, a consequence of volatility is that it could create opportunities to invest in companies at attractive valuations. We note that in many instances, stock valuations are currently not as attractive as two years ago but have still performed well.

Where valuations have risen too far, investors have the option to sell and move into areas that offer better value. At Newton, we use a collection of themes that stimulate debate and highlight opportunities to pursue. In an increasingly interconnected world, we believe that is important for investors to retain perspective on the true investment backdrop that will continue to shape their investment approaches.

Challenges ahead

Hurdles that may present themselves in 2013 could include a slowdown in the Chinese economy, plus the challenge of shifting from an exportled to a consumer-driven economy as well as the “once- in-a-decade” leadership transformation. The Greek crisis continues to rumble on, with many possible outcomes, including default. Moreover, 2013 is a year of elections, including in Italy and Germany. In our view, the “fiscal cliff” in the US, the pending combination of spending cuts and higher taxes that, if mishandled or subject to political paralysis, could cost 4-5% of GDP and tip the US into recession. All this would, in turn, ensure central banks across the globe remain ultra-loose in monetary policy, as the once unconventional policies become more conventional. We are now entering our fifth year of “zero interest-rate policies” and our fourth year of quantitative easing.

The world is now markedly one of “haves” and “have-nots”. In our opinion, the US, UK, Germany, Switzerland, and Norway feature among the “haves” as they are able to access debt at record low rates; whereas the likes of Greece and Spain are dependent on some form of bailouts. This pattern is also found at the corporate level with durable, well financed, highly visible and stable businesses among the “haves”; while small and medium-sized enterprises (SMEs) number among the “have-nots” facing difficulty in finding finance. This distinction is also reflected among individuals. We believe investing in the “haves” brings significant competitive advantages for an investor. Investing in companies able to establish meaningful and lasting competitive advantages in their cost of funding could serve the investor well over the medium term.

We continue to believe that avoiding companies that are exposed to excessive debt levels is desirable. The process of “deleveraging” (debt reduction), particularly in the West, is expected to take a long time and is unpleasant for all concerned. A failure to generate growth in excess of interest costs at the country level will mean that debt burdens will continue to rise in those countries. Treating the symptoms of too much debt – by lowering interest costs – does buy time for politicians to begin to make the necessary structural changes, but the debt problem itself remains unsolved.

In the US, there has been some evidence of the beginnings of this rebalancing, with a return of investment in capital equipment1. The banking system in the US is nowhere near as concentrated or as large a proportion of the economy as in Europe and the UK. The US has moved further than Europe to repair its banking system and, fragile though the backdrop remains, the US is looking relatively more attractive as an investment opportunity.

Returning capital to shareholders

In our view, a focus on companies that pay regular cash dividends generally leads investors to hold a portfolio of companies that are reasonably valued and able to generate sustainable cash flows. Such companies, in our experience, tend to be sensibly managed and financed, and allocate shareholders’ funds with a view to long-term returns on capital. We think dividend yields can be a useful tool for identifying quality companies that are disciplined and efficient in their capital allocation and cash flow management, at attractive valuations.

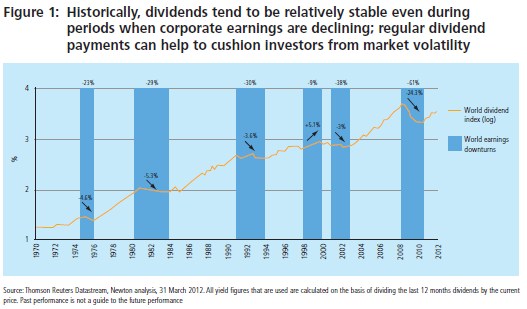

With the difficult economic conditions of recent years and prolonged record low interest rates, investors are coming to appreciate the power of regular dividend payments. Historically, dividend payments tend to remain relatively stable, even when company earnings decline. This may provide investors with a cushion for those times of market volatility.

In a world of “financial repression” and ageing populations, we think the “search for yield” from investments will continue to be an important requirement for investors. Despite pending tax rises on dividends in the US, we believe companies will continue to appreciate the benefits a sustainable and growing dividend payout can bring to its investors and stock price.

For the long-term investor, attractive equity returns are derived not simply from the receipt of dividends but from the accumulation of shares as a result of the reinvestment of those dividends. The compounding of investment returns by way of income reinvestment can be a powerful driver of equity returns over the long run, particularly so in a volatile world.

1. Bloomberg, 30 November 2012.

More Related Content...

|

|

|