Running the winners and cutting the losers

|

Written By: Gianmarco Mondani |

Gianmarco Mondani, GAM’s investment director for non-directional equity, explains how earnings revisions can be used to generate sustainable alpha.

Although the world’s global economic problems appear to have eased for the time being, long-term solutions remain evasive – meaning that markets are likely to continue to be plagued by bouts of volatility, short-termism and oscillating risk appetite.

In this environment, attempting to harness beta may lead to performance that is as erratic and rollercoaster as the markets, causing sleepless nights for all but the most intrepid investors. For those looking for consistent returns independent of global economic growth, the delivery of genuine alpha appears to be a sounder investment strategy.

This is of course easier said than done. In their search for alpha, many managers adopt an investment approach that prioritises quality criteria – favouring companies that have strong balance sheets, good management, healthy cash flow and robust earnings growth. Whilst this sounds sensible in theory, in reality such companies are generally wellknown by the market and these qualities are already fully reflected in their share prices.

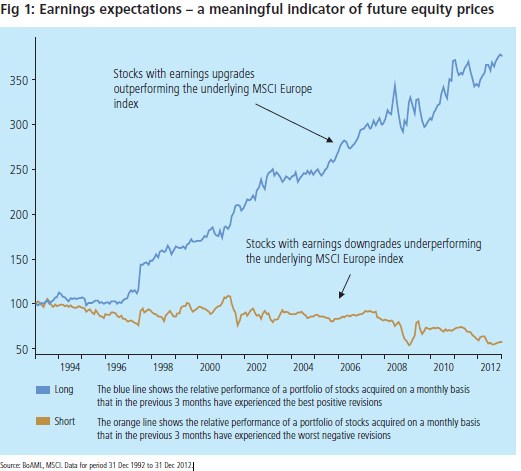

Instead, identifying in advance where and when these quality characteristics are likely to change has proven to be a more successful and sustainable approach to generating returns. Having analysed the many potential catalysts for change in a company’s share price, we have found that the one strategy that consistently performs well is the anticipation of earnings surprises. This means buying stocks that are likely to beat consensus expectations and selling short those that look like they might miss them. The key to this strategy is to stay well ahead of the crowd by using bottom-up analysis to form independent views on companies and sectors, and then assessing whether brokers’ upgrades or downgrades are likely to be right or not.

If it’s that straightforward, why aren’t all investors investing this way? The answer seems to lie in investor psychology. Earnings revisions correlate with price performance – if a share price is rising, usually it is due to information in the market. If that information is positive, the company is more likely to beat expectations. By buying earnings revisions, a fund manager is buying price momentum. This dynamic goes against an investor’s psychological bias to sell stocks on strength and buy stocks on weakness. In fact statistical analysis indicates that one should do exactly the opposite. And with analysts often slow to revise their expectations, this inefficiency can create great opportunities for alpha generation.

Historical evidence shows that earnings revisions work best when supported by valuation and price momentum. Companies with cheaper valuations typically experience more significant pricing impacts from positive earnings revisions than those with expensive ones. Meanwhile supportive price momentum strengthens the investment case for a stock, reinforcing the discipline of buying on pricing strength and selling on weakness – in other words, running the winners and cutting the losers.

The beauty of this kind of earnings revision approach is that it identifies stocks that are capable of strong growth, irrespective of the health of the broader economy or the global stock markets. Critically, this gives investors a strategy to make money regardless of how economic or market conditions develop. The differential between winners and losers in lowgrowth environments such as today’s is particularly strong, creating many exciting opportunities for those who know how to unearth them.

A focus on single stock differentiation and the creation of a low-beta, non-directional portfolio can lead to an interesting range of diversified positions. For example, we currently see attractive opportunities on the long side in some of the outsourcing providers and low-cost airlines – both of which are benefiting from the European austerity drive but continue to trade on attractive multiples. Meanwhile, pure media companies suffering from a structural decline in viewership, and European utilities plagued by government intervention and falling demand, provide fertile hunting ground for short positions, particularly given they continue to trade at a premium.

In today’s world, alpha is in short supply and is likely to remain so. But using earnings revisions to drive stock selection can provide a consistent and reliable means to deliver it – offering protection from the vagaries of macroeconomic developments and stock market volatility and driving strong returns for investors across a full range of market cycles.

More Related Content...

|

|

|